Real Estate Investment Trusts, or REITs as they are more commonly known, are a great source of income.

It is not uncommon to find REITs with dividend yields that are several percentage points above the S&P 500 average, which hovers around 2% right now.

Realty Income (O) and Omega Healthcare Investors (OHI) are no different.

Both stocks have dividend yields well above the index average.

And, each stock has a long history of raising its dividend regularly. Realty Income and Omega are both Dividend Achievers, a group of 265 stocks with 10+ years of consecutive dividend increases.

Realty Income and Omega are high-quality dividend stocks, because they have strong real estate portfolios and generate steady cash flow.

If an investor were to choose between them, which one would be the better investment today? This article will seek to answer that question.

Business Overview

The REIT business model typically involves purchasing properties, through a mix of debt and equity financing. The cash flow generated by those properties helps purchase new properties, which then throw off additional income.

This helps create a “snow-ball†effect that helps REITs generate growth over time. In addition, they can periodically raise rents to build revenue growth.

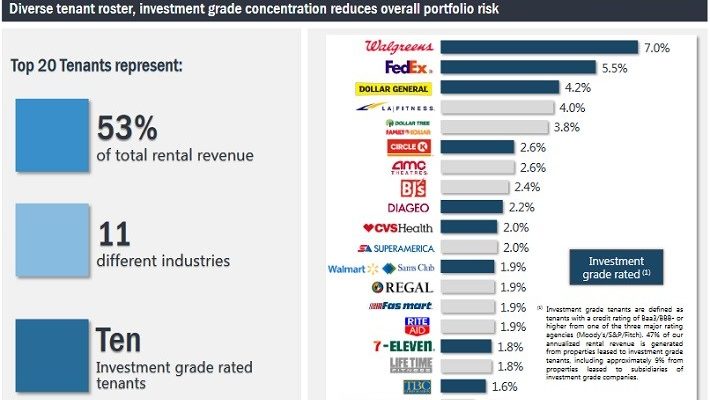

Realty Income’s portfolio is comprised mostly of retail properties, such as retail outlets, drug stores, movie theatres, and fitness gyms.

In all, it has a portfolio of more than 4,700 properties.

(Click on image to enlarge)

Source: 4Q Investor Presentation, page 14

Approximately 79% of Realty Income’s rental revenue comes from retail properties.

Omega has a different property portfolio than Realty Income. It invests in healthcare properties. It is the largest REIT focused on skilled nursing.

Approximately 86% of Omega’s 981 operating facilities are skilled nursing. The other 14% is comprised of senior housing.

Its portfolio is spread out across 42 U.S. states, and the U.K.