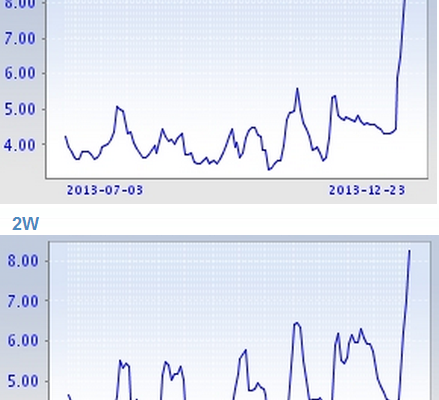

China’s short-term rates have spiked again. In a replay of this summer’s liquidity squeeze (see post), term money market rates (SHIBOR and repo rates) have risen across the board. The PBoC had to inject liquidity to stabilize the situation.

WSJ: – The People’s Bank of China said Friday it had been forced to inject more than 300 billion yuan (US$49.2 billion) into China’s money markets over a three-day period after the interest rates banks charge each other for short-term loans surged to 8.2%. The injection helped bring down rates to 5.6% by Monday morning.Â

Last week’s levels were the highest since June’s cash squeeze sent short-term rates soaring above 28%. Then, China’s lenders were caught in a credit squeeze caused by a combination of factors, ranging from lower capital inflows and seasonal tax payments to a mismatch between banks’ short-term funding and longer-term lending. The PBOC let the problem fester before stepping in, to teach banks a lesson.

|

| Source:Â China Foreign Exchange Trade System & Nation Interbank Funding Center |

The explanation this time around seems to be reduced government spending. The banks and the economy as a whole rely on seasonal fiscal stimulus, which is not nearly as potent this time around. Reforms focused on reducing “unnecessary” government spending are being put in place.

WSJ: – Those seasonal factors have come into play now as well. But “the recent rate spike is, to a large extent, a reflection of the government’s tighter stance on spending,†Citigroup economist Ding Shuang said.Â

The Chinese government usually draws down fiscal deposits — the amount of funds the government keeps in the financial system—more quickly in December, as it speeds up spending and fiscal disbursements before the end of the year, UBS economist Wang Tao said in a recent note.Â

That boost in government spending adds liquidity to the banking system, and the PBOC normally withdraws liquidity at the end of the year to offset the inflows. This time, though, the government’s tighter fiscal policy means year-end spending has been restrained, Ms. Wang said.Â

China’s Communist Party has launched a campaign this year to crack down on unnecessary government spending, from official banquets to investment projects. Even budgeted investment projects that are deemed unnecessary won’t get funding, Citigroup’s Mr. Ding said.