A previously obscure inflation metric called shocked the world this week by rising at an annual rate of 8%. This pretty much rules out a Fed rate cut in the near term.

Responding to the prospect of “higher for longer,” the 10-year Treasury yield spiked back up to 4.3%, guaranteeing 7%+ mortgages and 10%+ car loans for at least the next few months.

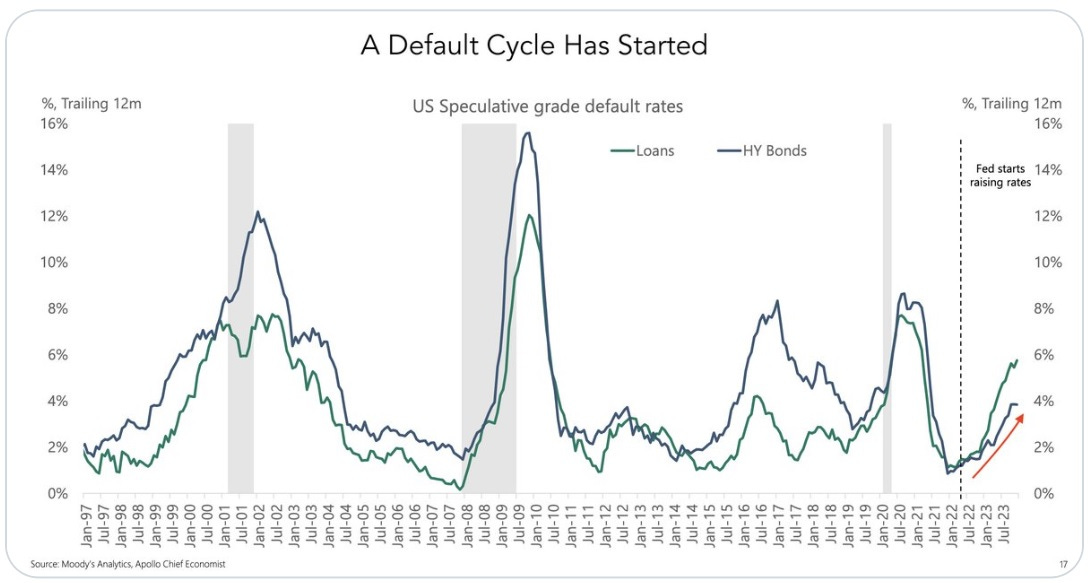

The real kicker is that the economy was already headed for a serious downturn as high-yield corporate debt defaults accelerate …

… and consumer loans blow up:

Credit-card and car-loan delinquencies are at their highest point in more than a decade

(MarketWatch) – Consumer debt keeps climbing, and the strain is showing in the mounting number of car loan and credit card delinquencies, according to new data from the Federal Reserve Bank of New York.

Total household debt, including mortgages, car loans, credit cards and student loans, climbed to $17.5 trillion in the fourth quarter, according to the New York Fed’s quarterly report on household debt.

But researchers are particularly watching credit-card balances and car loans, for which transitions into delinquency keep climbing above prepandemic levels. “This signals increased financial stress, especially among younger and lower-income households,” Wilbert van der Klaauw, an economic research adviser at the New York Fed, said in a statement.

During the fourth quarter, 8.5% of credit-card debt became 30 or more days past due and 6.3% flowed into serious delinquency, meaning it was at least 90 days past due.

The second quarter of 2011 was the last time serious delinquency rates were higher, New York Fed data shows.

For car loans, 7.6% of debt became 30 days late and 2.6% became 90 days late. The second quarter of 2010 was the last time the share of car-loan debt was higher for delinquencies that were at least 90 days behind.

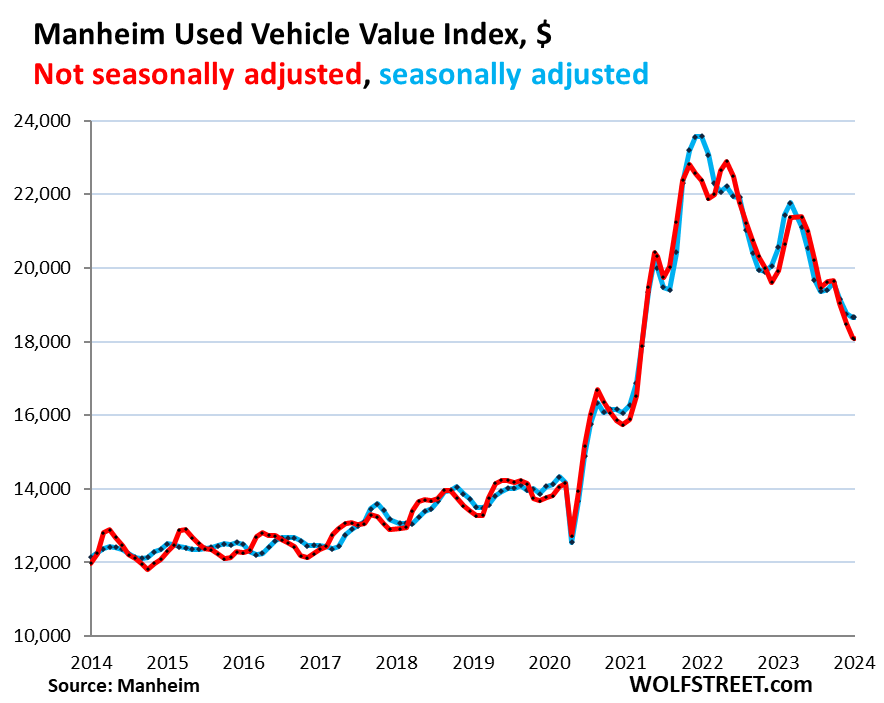

Here’s a video and a chart illustrating the auto market pile-up:

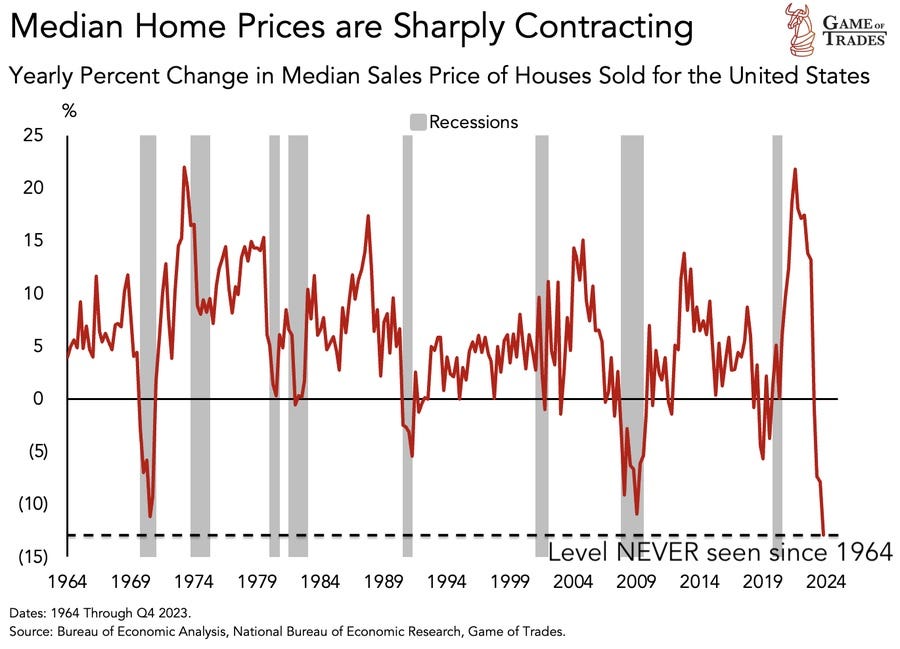

Home prices, meanwhile, are behaving like a bursting bubble:

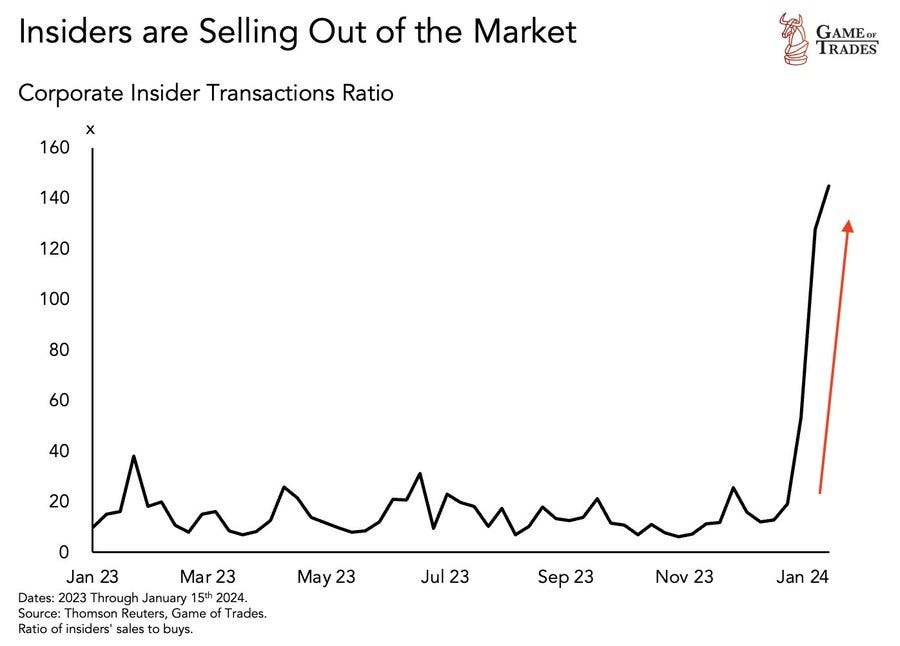

Corporate insiders — who see order flows and pricing trends in real-time — are voting with their stock portfolios:

It Takes A Crisis

The idea of the US drifting gently into a mythical nirvana where already over-indebted people and businesses just keep borrowing never made sense. Now, with inflation sticky and the Fed unable to aggressively ease, it makes even less sense.Instead, one or two of the above sectors will morph from “problem” to “crisis,” a growing number of people will refuse to buy what realtors and car dealers are selling, and prices will plunge. And sometime in 2024, this article series’ name will change from “Recession Watch” to “Deflation Watch.”More By This Author:The Student Loan Debt Spiral Starts: Credit Card And Auto Loan Delinquencies Highest For Millennials Household Debt Tops $17.5 Trillion and Americans Are Feeling the StrainNo Whispers Of Wal-Mart On Wall Street