QUESTION:Â Hi Martin,

I live here in Fairfax County, VA. Wow! The government largesse almost feels like 2006 again. Real estate values have almost climbed back to 2005 levels. I cannot believe that people here are paying 600k for 15-year-old townhomes under high tension wires. I guess it is the low interest rates. Those units can rent for about 2500/month. All the traditional investment ratios are screaming code red. Ratios like Price/Rent. GRM, Cap Rate, etc, indicate extremely overbought again. However, the rents are higher than in 2005-06, so prices are not as overbought as back then – though they are getting there.

The anecdotal evidence for a top keep piling up. I know of a few couples who are buying bigger homes and keeping the older homes, and using them as rentals.

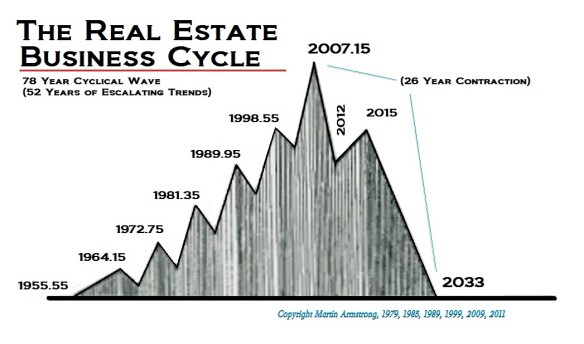

This brings me to a paper I read that you wrote back in November, 2009, while you were in prison. It seems so prescient. You stated that 2015 would be the high, as you stated 2015.75 would be for the debt bubble.

From this paper you wrote over five years ago, you predicted a bump up into 2015 with a drop thereafter for years. It worked out perfectly so far – a 2012 low to a 2015 high.

How bad will it get for the average mortgage payer? How bad will it get for residential real estate? I own several paid down/paid off rental houses in Maryland, across the Potomac that generate a ton of cash flow. What should I do? I kind of have become dependent on the free cash flow. What will happen with rents? They have gone way up over the past several years, as the foreclosures have displaced (continue to displace) so many wage earners.

I ask, because you have mentioned real estate in passing, but I have not seen you directly address it like you did in that 2009 paper.

Anyway, I intend to come to Princeton this time around later in the year. I am a quiet person, so I will be the one keeping to himself.

Thank you so much for all that you have done. All these cycles make so much sense now that I have been studying your work for the past couple years. It answers the questions I have had, but couldn’t answer.