This report focuses on my top picks and pans for all sector funds. I will follow this summary with a detailed report on each sector.

My top ETFs and mutual funds have high-quality holdings and low costs. As detailed in “Low-cost funds dupe investorsâ€, there are few funds that have both good holdings and low costs. While there are lots of cheap funds, there are very few with high-quality holdings.

I think there are at least two causes for this disconnect. First, there is, in general, a lack of independent research on ETFs and funds. Second, I think it is fair to say that there is a severe lack of quality research into the holdings of mutual funds and ETFs. There should not be such a large gap between the quality of research on stocks and funds, which are simply groups of stocks.

After all, investors should care more about the quality of a fund’s holdings than its costs because the quality of a fund’s holdings is the single most important factor in determining its future performance.

My Predictive Rating system rates 7400+ ETFs and mutual funds according to the quality of their holdings (Portfolio Management Rating) and their costs (Total Annual Costs Rating).

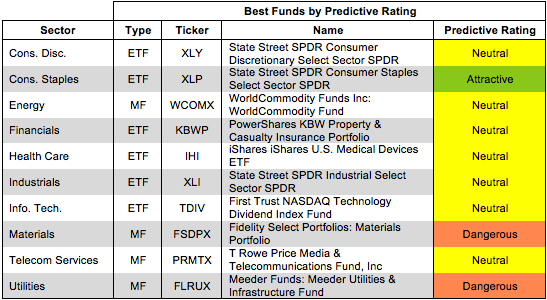

Figures 1 shows the best ETF or mutual fund in each sector as of January 13, 2014.

For a full list of all ETFs and mutual funds for each sector ranked from best to worst, see my free ETF & mutual fund screener.

Figure 1: Best ETF or Mutual Fund In Each Sector

Source: New Constructs, LLC and company filings

Source: New Constructs, LLC and company filings

State Street SPDR Consumer Staples Select Sector SPDR (XLP) is my highest-rated Consumer Staples ETF and earns my Attractive rating. XLP allocates over 39% of its asets to Attractive-or-better rated stocks and has low annual costs of only 0.20%.

The Kroger Company (KR) is one of my favorite companies held by XLP and earns my Attractive rating. KR has grown after-tax profit (NOPAT) by 23% compounded annually over the past decade. Its soon to be completed acquisition of Harris Teeter (HTSI) should be a further boost to growth. At the $2.4 billion acquisition price, HTSI will boost KR’s return on invested capital (ROIC) while also giving it a greater geographic reach. Despite KR’s consistent profit growth, the market has low expectations for its future cash flows. At its current valuation of ~$39/share, KR has a price to economic book value ratio of 0.8, which implies that the market expects a permanent 20% decline in after-tax profit (NOPAT) for the grocery chain. KR should comfortably exceed those pessimistic expectations and reward investors.