US Treasury yields finally get bullied further higher by mutual fund flows selling duration. A January pause from the Fed is also on minds, even as a 25bp cut is coming on Wednesday. Still, in the eurozone, we see a reasonable chance that euro rate markets will undershoot the priced-in landing point of the ECB in the near term, below our own forecast of 1.75%.

US Treasury yields on a rising trend and number of cuts in 2025 questioned

It’s been clear from mutual fund data (EPFR) that there has been selling of duration in the past three weeks. Effectively there has been a liquidation of some 1.5% of assets under management in long dates every week, bringing the cumulative to a 4% sell down in the past three weeks. This had little effect up until last week, mostly as it had been offset by fast money on the other side. That support has waned, and the net market mood now is to square up into the end of the year.We still think this ends up with cash moving into the front end, and should ultimately pull the 2yr yield lower again. But as noted last week, the 10yr yield has become more untethered. Last week’s CPI report did not help, even if the reaction to the data itself was perversely for lower yields, at least initially. There is chance this week for the PCE inflation readings to redeem the inflation story with some 0.2% month-on-month readings (as opposed to 0.3% MoM for core CPI). But even there, the core measure is anticipated at 2.9% year-on-year. That’s effectively a “3% inflation economy”, which is a tad uncomfortable. It reinforces our call for a pause in Fed easing in early 2025.The Fed will cut this week by 25bp. But will likely pause at the January meeting. It’s not just the inflation data, it’s the unknowns coming from the beginning of the Trump administration post the 20th January inauguration. The entire curve is feeling the pressure of this right now.

Structural growth concerns feed dovish euro rates sentiment

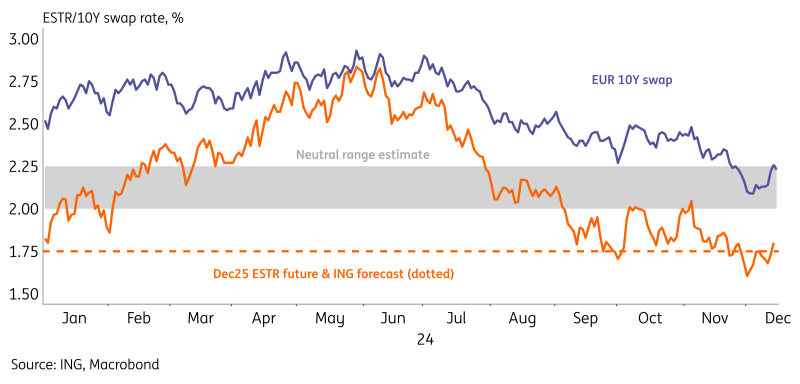

In euro rate markets the tussle is between following US moves versus focusing on the domestic growth deterioration. The relatively hot US inflation numbers and an incoming Trump administration stand in stark contrast with the structural growth concerns in the eurozone. Just last week we noted that 5Y5Y inflation swaps had dipped below the European Central Bank’s target of 2%, underlining market concerns about the more long-term prospects of the eurozone economy. And while we have edged above this symbolic handle over the past week, the risks to the downside are clear.Going into the beginning of 2025 we see a reasonable chance for both near term and structural growth worries to intensify, and with it an undershooting of the ECB landing zone by markets. Before last week’s ECB meeting, markets were already positioned for a lower terminal rate than the 1.75% we have pencilled in (see chart). Monday’s services PMIs surprised to the upside, but overall sentiment remains dovish, and euro rates ended up lower on the day.Having said that, after an initial undershooting, we do have a higher target for the 10Y swap rate as we progress through 2025. The ECB won’t have to cut far below neutral as consumption growth should recover. US rates will find upward pressure from Trump’s inflationary policies and high issuance, which will in turn spill over to the back end of global yields. In the meantime, QT continues in the background helping the normalisation towards a steeper curve.

Markets priced in an ECB terminal rate below 1.75% before last week’s meeting

(Click on image to enlarge)

Tuesday’s events and market views

In terms of data we will get Germany’s Ifo and ZEW survey outcomes, which will be watched carefully given not just the economy, but now also the country’s politics are in the spotlight. Consensus sees a further deterioraration. From the US we have retail sales and industrial production numbers. For speakers we have the ECB’s Kazimir and Rehn, both known hawks. For issuance we have the UK with £3.75bn of 5Y gilts, and the US with a 20Y bond auction for a total of $13bn. More By This Author:

Rates Spark: Markets Sniffing Out Some 2025 Impulses