Image source: The market is gunning for a 50bp cut. But could that juice equities? Is that what the Fed wants? Is there a need for a big cut? On balance, a contrarian 25bp cut could prove a bigger statement. In Europe, despite lower rates, the uptake of the ECB’s MRO liquidity facility remains low, reflecting ample reserves.

Image source: The market is gunning for a 50bp cut. But could that juice equities? Is that what the Fed wants? Is there a need for a big cut? On balance, a contrarian 25bp cut could prove a bigger statement. In Europe, despite lower rates, the uptake of the ECB’s MRO liquidity facility remains low, reflecting ample reserves.

We’re in the 25bp cut camp. But either way we brace for some potential upside to market rates

The market is urging the Federal Reserve to deliver a 50bp cut, now. It’s not fully discounted, but on balance the market is more positioned for a 50bp cut than a 25bp cut. If the Fed delivers a 50bp cut it could be justified as the Fed getting ahead of the game and overdelivering on an underpriced 50bp cut. The counterargument is that a 50bp cut caves to the market call for a big cut. It could also juice the risk asset space, which while not awful, could present a mild irritation for the Fed.

Remember, rarely if ever has the Fed commenced a rate-cutting process with risk assets practically at their highs (or not far off)! Think about that, and what it infers.

Therein lies the argument for a 25bp cut. It’s more measured. It does not give risk assets the juice craved. And in a way, it has the Fed taking back some control by deciding not to bow to the market pressure for a bigger cut. On balance, that’s why we’re in the 25bp cut camp. We can see the pendulum swinging in the direction of a 50bp cut. But in a way, a more measured 25bp move might just be enough for the Fed to make an even bigger statement than a 50bp move would.On market rates, under delivery in the guise of a 25bp cut leaves market rates vulnerable to a move higher, as they are already pricing in quite some cuts ahead, and quite aggressively discounted up front, as can be gleaned from the 2yr yield at some 175bp through the funds rate; its deepest discount since the 1980s. In contrast, as a 50bp cut is not fully discounted, delivery should, theoretically, leave room for market rates to fall.We have a sneaking suspicion though that we could see a “surprise” reaction higher in market rates to whatever the Fed does. It’s happened before. In fact, it’s running at about 50:50 on the reaction function historically. Why potentially higher post a cut? All of the excitement is ahead of the game. Delivery then brings a sense of new reality to the equation, which can see a tactical adjustment higher as an impact, even if structurally it’s no more than a blip as rates ultimately re-test lower in subsequent weeks.

Limited uptake of ECB liquidity facility suggests ample reserves

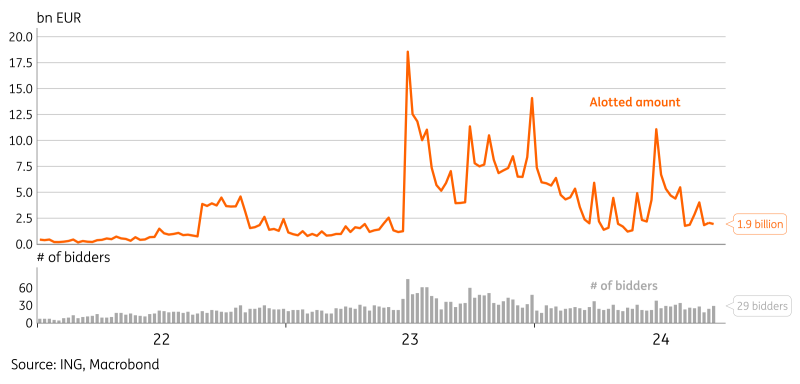

Despite the cheapening of the ECB’s main liquidity facility since last week, the low uptake suggests that liquidity conditions are still ample in the eurozone. The ECB cut the deposit rate by 25bp, but the Main Refinancing Operations (MRO) rate was cut by a further 35bp, to just 15bp above the deposit rate. This was part of the broader operational review and should help prevent liquidity squeezes as bank reserves become scarcer due to quantitative tightening. The ECB reported that only €1.9bn was allotted among 29 bidders this week, which is actually on the low side compared to the numbers earlier this year (see chart below).In contrast, the uptake of the short-term liquidity facility of the Bank of England has seen significant uptake since March and moved from around £1bn to the current £44bn in a matter of months. Also the spread between the policy rate and the market rate (Sterling Overnight Indexed Average) showed some tightening over this period. The pace of quantitative tightening has been relatively steeper in the UK, but nevertheless the tightening may be an omen of what is to come in the eurozone. Having said that, the tweak to the ECB’s MRO rate now provides a cheaper backstop in case of a sudden tightening of conditions, limiting the upside risk of market rates.

Limited ECB MRO uptake suggests ample liquidity in the banking system

Wednesday’s events and market view

The FOMC decision looms large tonight. Ahead of it, markets are likely to stick to their ranges given there are no other events on the calendars that could potentially still nudge the Fed this close to the decision. We only get mortgage applications and housing starts data.Following the UK CPI figures in the morning (which were in line with expectations), the European calendar only holds final eurozone inflation figures as well as several ECB speakers, including Austria’s Holzmann and Germany’s Nagel who is more hawkish this time.Primary markets are busier with Spain issuing up to €6bn in 4 to 20Y maturities and France active in short to medium term bonds as well as linkers for up to €14bn in total. The US Treasury sells US$17bn in 10Y TIPS. More By This Author:Resilient U.S. Retail Sales Suggests Fed Decision Will Be A Coin Toss The Commodities Feed: European Gas Sell-Off China’s Data Dump Shows That Time Is Running Out To Achieve This Year’s Growth Target