While few will bother with today’s extremely stale 1st revision of Q3 GDP data, now that the discussion has turned from how high and how long the Fed will hike, to when the first rate cut will come, moments ago the Biden BEA that in its second estimate of third quarter GDP, the revised print was even higher than initially reported, and instead of the original 4.880% number it was actually 5.160% (rounded to 5.2%), the highest since Q4 2021 and above the 5.0% estimate. Compared to the second quarter, the acceleration in GDP in the third quarter primarily reflected accelerations in government consumption and inventory investment offset by a reduction in consumer spending. Here are the full details:

Compared to the second quarter, the acceleration in GDP in the third quarter primarily reflected accelerations in government consumption and inventory investment offset by a reduction in consumer spending. Here are the full details:

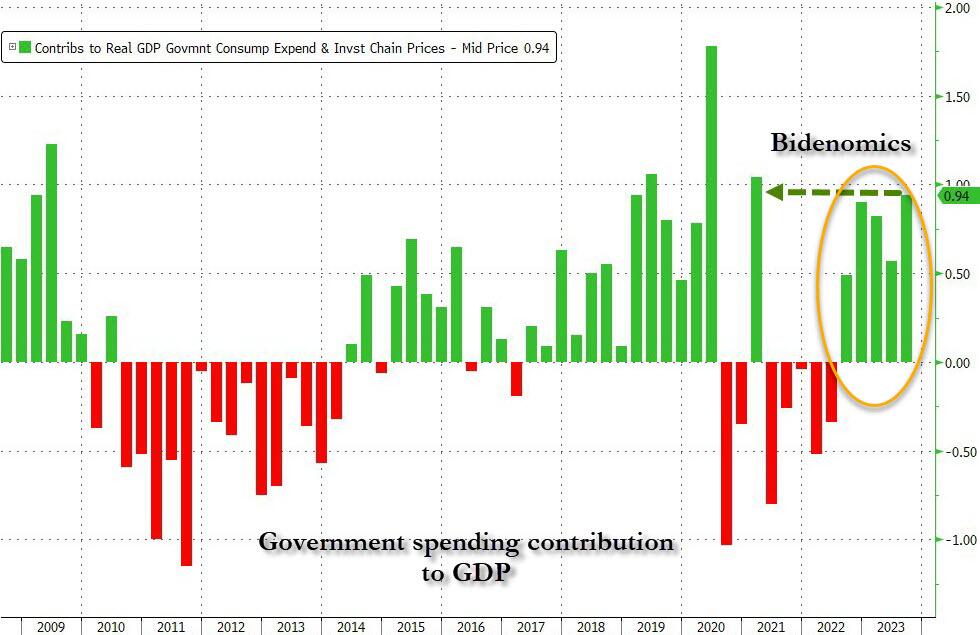

Of the above, government spending contributed a whopping 0.94% to GDP, or a 5.5% contribution. This was the highest in almost three years and one of the highest prints on record. Or in other words, “presenting Bidenomics.” Or as Trump’s former chief economist Joe Lavorgna puts it…

Or as Trump’s former chief economist Joe Lavorgna puts it…

Why is growth so strong? One factor has been government spending which grew an unsustainably 4.7% in real terms over the last year. Outside the pandemic, this is one of the fastest rates in decades and works at a cross purpose with monetary policy objectives

— Joseph Lavorgna (@Lavorgnanomics) November 29, 2023

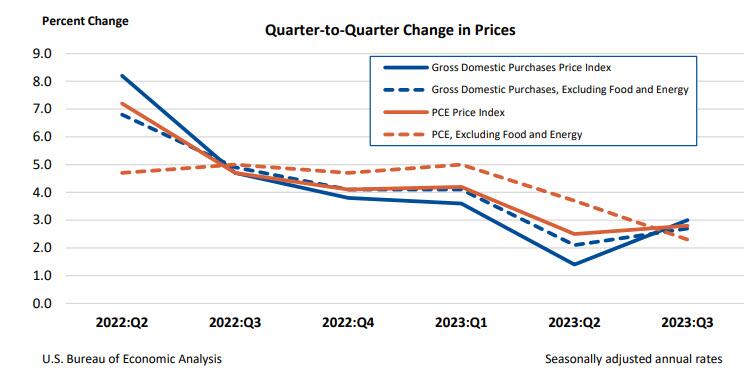

Elsewhere, Gross domestic purchases prices, the prices of goods and services purchased by U.S. residents, increased 3.0% in the third quarter after increasing 1.4% in the second quarter. Excluding food and energy, prices increased 2.7% after increasing 2.1%.More importantly, while the headline GDP price index came in at 3.6% or just higher than expected, the core PCE of 2.3% was both below the expected 2.4%, and below last month’s 2.4% original print. Elsewhere, real disposable personal income (DPI) increased 0.1 percent in the third quarter after increasing 3.3 percent (revised) in the second quarter. Current-dollar DPI increased 2.9 percent in the third quarter, following an increase of 5.8 percent (revised) in the second quarter. The increase in the third quarter reflected increases in compensation, proprietors’ income, and personal income receipts on assets that were partly offset by an increase in personal current taxes. Personal saving as a percentage of DPI was 4.0 percent in the third quarter, compared with 5.1 percent (revised) in the second quarter.Finally, turning to corporate profits, we find that these increased 3.3% at a quarterly rate in the third quarter after increasing 0.2% in the second quarter.

Elsewhere, real disposable personal income (DPI) increased 0.1 percent in the third quarter after increasing 3.3 percent (revised) in the second quarter. Current-dollar DPI increased 2.9 percent in the third quarter, following an increase of 5.8 percent (revised) in the second quarter. The increase in the third quarter reflected increases in compensation, proprietors’ income, and personal income receipts on assets that were partly offset by an increase in personal current taxes. Personal saving as a percentage of DPI was 4.0 percent in the third quarter, compared with 5.1 percent (revised) in the second quarter.Finally, turning to corporate profits, we find that these increased 3.3% at a quarterly rate in the third quarter after increasing 0.2% in the second quarter.

Corporate profits decreased 0.7 percent in the third quarter from one year ago.More By This Author:WTI Holds Gains After API Reports First Crude Draw In 6 WeeksRefill Of Strategic Petroleum Reserve Slowed By Companies Delaying Return Of Borrowed BarrelsVIX, Yields Spike As Ugly 7Y Auction Buyers’ Strike Sends Tail To One Year High