Second quarter earnings season officially kicks off on Wednesday with Alcoa Inc (NYSE:AA)’s report on tap. Analysts have been tracking preannouncements, consensus estimates and growth estimates for each sector, and the news is mixed.

Negative to positive preannouncements remain solid

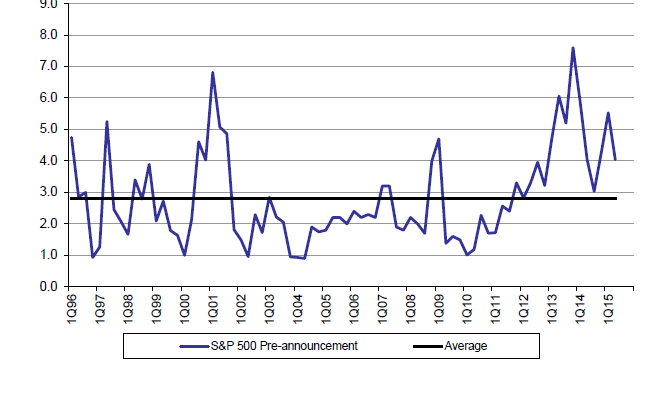

Citi (C) analysts Tobias Levkovich and Lorraine Schmitt pointed out that the ratio of negative to positive preannouncements has “moderated” since the first quarter. However, they added that the ratio remains above average, which of course is a positive sign for second quarter earnings. They cited a very interesting reason for the moderation in negative to positive preannouncements.

“It has become almost commonplace to see more negative preannouncements as management teams worry about potential shareholder lawsuits for not releasing material disappointment information early and thus, monitoring the data relative to trend is worthwhile,” they wrote in their “Monday Morning Musings” report.

They said the ratio slipped from the first quarter’s 4.5 to 4 for the second quarter, but it remains still well ahead of the long term average of 2.7. The second quarter preannouncement ratio is flat year over year.

Upside earnings surprises likely

Because the negative to positive preannouncement ratio is still higher than the average, the Citi team believes there is a higher chance of upside surprises because companies have set the bar for expectations quite low. They note that bottom-up consensus estimates suggest there will be a decline of 6% to 7% in earnings year over year, but they think it’s likely earnings will beat the consensus. Their own estimate suggests an increase of 2% year over year.

They said the significant decline in gas and oil prices year over year, plus the strengthening of the U.S. dollar are probably “restraining” trends in earnings per share. In particular, income for the Energy sector will likely plummet, widening from the first quarter’s 53% decline to a decline of more than 63% year over year for the second quarter.