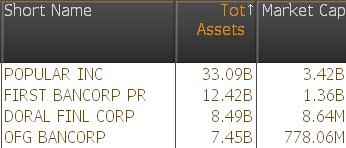

Based on Bloomberg data, Doral Bank is the 3rd largest (by assets) bank in Puerto Rico…or rather was. After a 58% collapse in the share price Friday, news broke after the close:

- *PUERTO RICO’S DORAL BANK PLACED UNDER FDIC RECEIVERSHIP

- *PUERTO RICO’S BANCO POPULAR AGREES TO BUY DORAL BANK OPERATIONS

Banco Popular will take the deposits (and 8 of Doral’s 26 branches) and the FDIC, aka America’s bad bank, eats the bad debt estimated to cost the Deposit Insurance Fund (DIF), as in the US taxpayer, some $748.9 million.

3rd largest (by assets) Puerto Rico-domiciled bank based on BBG data….

Â

The writing could perhaps have been on the wall…

Â

And it seems the news of the FDIC Receivership leaked…

Â

What happened is that the FDIC “fat-fingered” the failure release just before the market close, with the stock plunging as a result, then promptly retracted the release but the damage had already been done. After the close, the FDIC re-informed the public that the bank, which back in 2010 traded at $125, had indeed been liquidated.

From the FDIC Statement: