Â

Prospect Capital Corporation (PSEC) may very well be the most hated stock on Wall Street.

And I say this as an investor with skin in the game. Not only am I long Prospect Capital both personally and in client accounts, I also have reputational capital at risk: I chose Prospect Capital as my entry in InvestorPlace’s Best Stocks for 2015 contest. As of this writing, I am suffering the humiliation of being in seventh place.

So, just how hated is Prospect Capital these days?

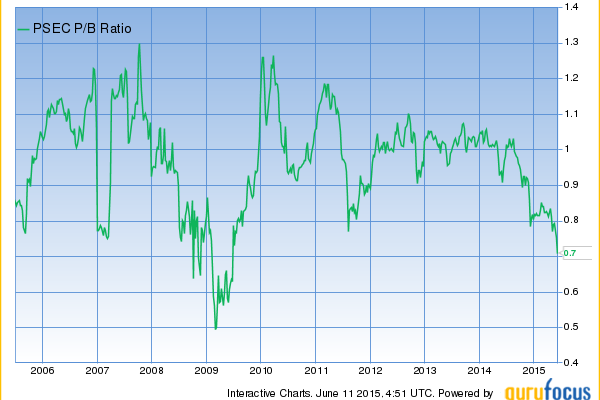

The stock is down 34% from its 52-week high and trades at a 30% discount to book value. To put that in perspective, the median business development company trades at a 6% discount to book value.

When a stock trades for just 70 cents on the dollar, it tells you that investors are questioning the reported book value. And there have been some well-publicized incidents in which Prospect Capital did indeed list identical assets at higher values than their peers, which partially explains investor hostility toward the company. Investors have also never forgiven Prospect Capital for slashing its dividend last year, even though the reduction was necessary given the de-risking of the company’s portfolio and the lower investment income that came with that de-risking.

My view has consistently been that, at the wide discounts to book value we’ve seen over the past six months, we have a wide margin of safety. According to Prospect Capital’s latest investor presentation, 75% of its portfolio is invested in secured first and second lien debt. The portion of the portfolio under the most scrutiny — the CLO equity tranches — makes up only 16% of the portfolio. If you were to write the entirety of the CLO equity to zero — which not even the most bearish of bears would do — Prospect Capital would still be trading at a deep discount to book value.

I spoke with Chief Operating Officer Grier Eliasek this week to get management’s take on Prospect’s recent share-price slide. Mr. Eliasek was very open with me and shared a set of slides that, until now, have not been released to the general public (see Prospect Capital Corporation Investor Presentation). Don’t worry, it’s ok to read them. They are based on public, reported numbers and are being reproduced with permission.

The usual caveats apply here. The data was prepared by Prospect Capital, and while I believe it to be factually accurate, I have not independently verified all of the data. And you should always assume that management has its own motives for sharing any data with the public.

So with that said, let’s jump into the presentation.

Figure 1: Historical Returns

Â

Figure 1 comes pretty close to stock touting, but it is instructive nonetheless. This chart shows the subsequent total returns (capital gains + dividends) that investors experienced the last time Prospect Capital traded at deep discounts to book value. On March 17, 2009, Prospect Capital traded at a 30% discount to book value, just as it does today. And over the 12 months that followed, the stock returned 94%.