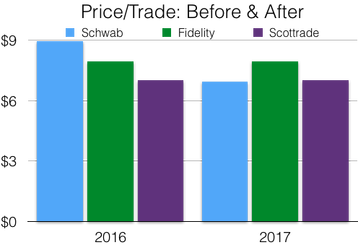

Last week, Schwab cut its trading fee from $8.95 to $6.95, kicking off the 3rd Online Brokerage Price War – an occurrence that has happened every five or six years since the dot-com boom. Here’s what this “price war†means for the retail investor and the online brokerage community:

Short-Term Scramble

The next few weeks will see Schwab’s (SCHW) competitors scrambling to reset marketing campaigns, hold emergency meetings at the executive level and rethink their 2017 operating models.

Two of Schwab’s largest rivals, E*Trade (ETFC) and TD Ameritrade (AMTD), are in the midst of acquiring super-discount brokers OptionsHouse and Scottrade, respectively. These brokers charge $5-7 per trade, but their acquirers have stuck to $9.99 trades since 2010. If E*TRADE and TD plan to start charging their newly acquired customers $9.99, then Schwab’s latest price cut might lure price-sensitive investors, at a time when their primary broker is distracted with integration activities. Â

In the short-term scramble, we will be watching to see how Fidelity responds, if TD and E*Trade sync their prices with their new acquisitions and what it means for lower-cost firms such as Interactive Brokers, TradeKing and TradeStation, who are already being challenged by upstarts like RobinHood and TastyWork.

Falling Fees, Shifting Valuations

Historically, when one large broker slashes fees, the rest follow suit fairly quickly. That’s why online brokerage stocks plummeted 10% last week: they’ll all be forced to drop fees to stay in the game. Consumers should watch for new deals as brokers get more aggressive on their acquisition bonuses.

Why now? A Historical Reference

The first price war occurred in 2005, after online brokerage valuations tumbled 90% since the dot-com burst in 2000. Brokerages wanted to build their customer bases and rely less on commission fees, so they slashed trading fees, and started focusing more on mutual fund fees and parallel banking services, which provide steadier revenue streams than trading.