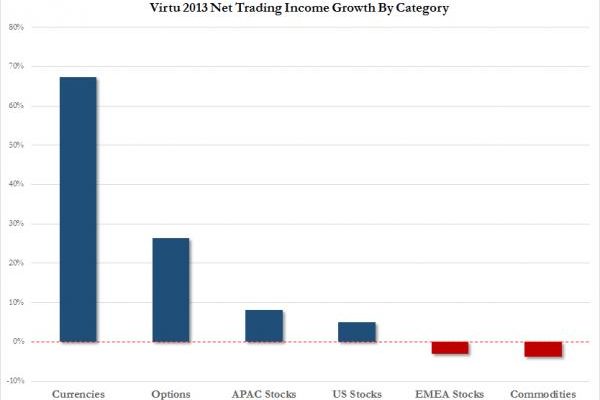

Almost a month ago, we wrote “This Is The One Financial Product Now Targeted By The HFT Swarm”, in which after briefly perusing the Virtu S-1 filing, we concluded that “one product stood out. It is highlighted on the chart below: FX.”

This Is The One Financial Product Now Targeted By The HFT Swarm:

Sadly, with increasingly more homo sapiens-type banker FX traders being laid off left and right for pervasive and ubiquitous manipulation of currencies (who can forget the infamous “Cartel” chat room, JPM’s head of spot trading presiding), what this means is that more and more algos will rush into this product to fill the voids left by carbon-based traders.

Â

And for those trading FX, our condolences: because the typical bizarro, idiot moves that previously were reserved for stocks are now sure to take over the final bastion of capital markets. In other words, the next time you feel like the USDJPY is trading as if it is in need of a software update, you will be right.

Â

Then again, in a world in which FX is the one battleground where central bankers now joust every minute, we can’t wait for the reaction when some fat finger algo decides to take USDJPY higher by 1000 pips, or crashes the EURUSD by 2000, “just because.” Surely the look of sheer panic on the faces of “central planners” everywhere in that particular “Jerome Kerviel Kodak moment” would be even more priceless than the stock of VRTU upon IPO. Speaking of, we wonder: will VRTU algos ramp VRTU stock to infinity, or is there some conflict of interest here?

We are happy to report that this time the mainstream media is following our reports much more closely then five years ago, because overnight none other than Bloomberg came out with “High-Frequency Traders Chase Currencies as Stock Volume Recedes” in which we read, guess what, “Forget the equity market. For high-frequency traders, the place to be is foreign exchange. Firms using the ultra-fast strategies getting scrutiny thanks to Michael Lewis’s book “Flash Boys†account for more than 35 percent of spot currency volume in October 2013, up from 9 percent in October 2008, according to consultant Aite Group LLC. It’s the opposite of equities, where their proportion shrank to 50 percent in 2012 from 66 percent four years ago, according to Rosenblatt Securities Inc.”