While the BOE kept rates unchanged at 0.5% as expected, the market was surprised by both the hawkish undertones of the statement and the surprising addition of Haldane to the list of dissenters (McCafferty and Saunders), which made the decision a 6-3 affair when markets were expected a 7-2 split.

MPC vote by a majority of 6-3 to maintain #BankRate at 0.5% pic.twitter.com/mn214NAKeh

— Bank of England (@bankofengland) June 21, 2018

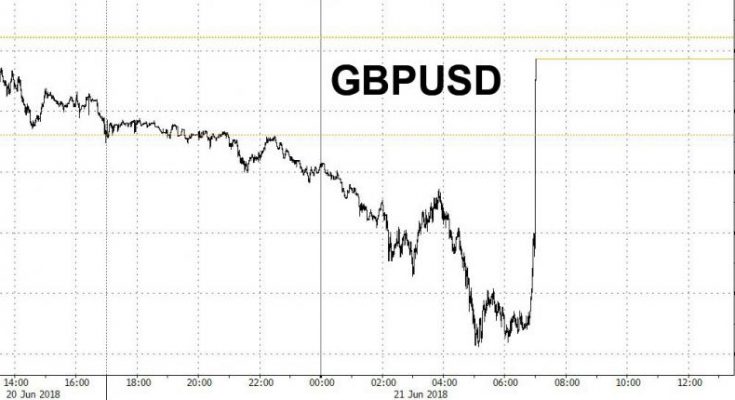

The flip by BoE Chief Economist Haldane was surprising due to his recent vote for a hold; as a result, odds of a rate hike in August, when the BOE will publish new estimates, have been sharply boosted, which is in turn reflected in cable, which has surged nearly 100 pips rising above 1.32 in kneejerk reaction.

There were no surprises in the other aspects of the decision:

- The vote split on corporate bonds:Â 9-0 in favor of maintaining the current stock of corporate bonds at GBP 10bln

- The vote split on APF:Â 9-0 in favor of maintaining the current stock of UK government bond purchases at GBP 435bln

Adding to the hawkish undertone, the BoE said it now intends not to reduce its balance sheet until Bank Rate reached around 1.50% (the previous guidance around 2.00%), although it added that “in the event that potential movements in Bank Rate are judged insufficient to achieve the inflation target, the reduction in the stock of assets could be amended or reversed”:

Since the previous guidance, the Committee has reduced Bank Rate from 0.5% to 0.25% in August 2016 and has noted that it could lower it further if required.  Reflecting this, the MPC now intends not to reduce the stock of purchased assets until Bank Rate reaches around 1.5%, compared to the previous guidance of around 2%.  Any reduction in the stock of purchased assets will be conducted at a gradual and predictable pace. Decisions on Bank Rate will take into account any impact of changes in the stock of purchased assets on overall monetary conditions, in order to achieve the inflation target.Â