“Pound strength has been one of the key themes so far this month even as the outlook for U.K. growth continues to deteriorate. Traders seem suddenly determined to now skew all U.K. news positively again, no matter what the facts are,†former trader Mark Cudmore wrote this morning, before reminding you that “inflation rising faster than wages shouldn’t be a supportive environment for British assets.â€

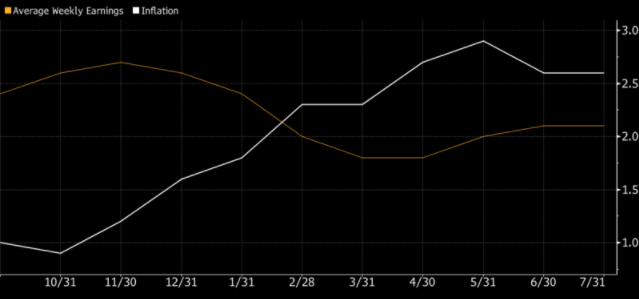

He is of course referencing the fact that FX pass through inflation seems to have put the BoE in an awkward spot as this week’s hotter-than-expected CPI print argued for a more hawkish tilt, while the latest read on wage growth shows that compensation isn’t keeping pace. Here’s the chart:

The CPI print helped drive GBPUSD to a 12-month high and while the wage numbers pushed it back lower a bit headed into the BoE this morning, the trend is clear:

So all eyes are on the vote. 7-2 could worry those concerned about inflation while 6-3 would telegraph a hawkish shift.

Here’s the decision, just out:

BANK OF ENGLAND VOTES 7-2Â TO MAINTAIN BENCHMARK INTEREST RATE

BANK OF ENGLAND MAINTAINS BENCHMARK INTEREST RATE AT 0.25%

BOE HOLDS CORPORATE BOND PLAN AT 10 BLN PNDS

BOE HOLDS ASSET PURCHASE PLAN AT 435 BLN PNDS

The initial move was a knee-jerk lower, but the pound is now on the rebound as “the majority of Bank of England policy makers judge that if economy develops as predicted, some withdrawal of monetary stimulus is likely to be appropriate over the coming monthsâ€:

FTSE is responding in kind, falling in tandem with the pound rally:

More to come…