Image Source:

Image Source:

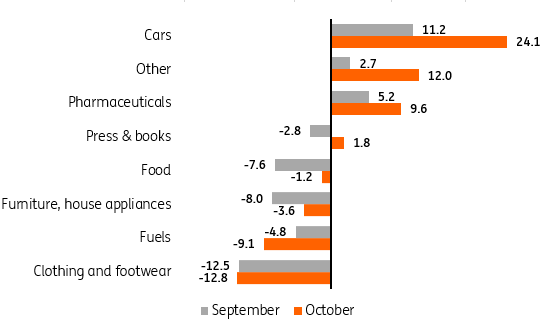

The high fuel sales base from 2023 promotions reduced annual retail sales in October, but other categories improved. Those involved in flood recovery efforts likely returned to normal activities. While consumption growth slowed in the second half of 2024, it did not plummet. With substantial savings, spending is expected to gradually improve.Retail sales of goods increased by 1.3% year-on-year in October (ING: 2.2% YoY; consensus: 0.5%) after a very weak September, when sales fell by 3.0% YoY. Seasonally adjusted data indicate a 5.6% month-on-month growth in sales, following a 6.7% MoM decline in September, so the bounceback from the last month of the third quarter was not full.On an annual basis, there were improvements in many categories. A substantial rebound was seen in the sales of cars, motorcycles, and parts (up by 24.1% YoY, after 11.2% YoY the previous month) and the “other” category (12.0% YoY vs. 2.7% YoY).Annual changes in other sales categories looked better than in September, except for fuels (-9.1% YoY vs. -4.8% YoY) and clothing and footwear (-12.8% YoY vs. -12.5% YoY). In the case of fuels, this was mainly due to a high base effect. A year ago, drivers were stockpiling fuels taking advantage of promotional prices. The ongoing decline in the clothing and footwear category may reflect a price barrier.Sales improved in the majority of spending categories in OctoberRetail sales of goods (real), %YoY Source: GUS.October’s sales data eases concerns about the economy’s recovery after a very weak retail performance in September, largely driven by one-off events (the impact of floods on consumer behaviour and activities). Consumption remains the main recovery driver, but the second half of 2024 shows a slowdown compared to the first half.Slightly slower nominal wage growth and higher inflation have somewhat restrained real income dynamics. Additionally, fears of future cost-of-living increases, geopolitical threats, and a higher propensity to save have contributed to cautious consumer spending. Behavioural factors, such as increased savings, play a significant role. Current price levels may also be a barrier for less affluent households.Given the better-than-expected industrial production data for October and the rejection of the most pessimistic retail sales scenarios, we still see potential for GDP growth in the fourth quarter of 2024 of around 3% YoY, compared to 2.7% YoY in the third quarter of this year and 2.7% for 2024 overall. We anticipate a rebound in the second growth engine, fixed investment, in 2025, which should allow economic growth to accelerate to 3.5% next year.More By This Author:FX Daily: New Season – Trump Tariff Show Asia Morning Bites For Tuesday, November 26Rates Spark: Downside Bias For Market Rates In Near-Term

Source: GUS.October’s sales data eases concerns about the economy’s recovery after a very weak retail performance in September, largely driven by one-off events (the impact of floods on consumer behaviour and activities). Consumption remains the main recovery driver, but the second half of 2024 shows a slowdown compared to the first half.Slightly slower nominal wage growth and higher inflation have somewhat restrained real income dynamics. Additionally, fears of future cost-of-living increases, geopolitical threats, and a higher propensity to save have contributed to cautious consumer spending. Behavioural factors, such as increased savings, play a significant role. Current price levels may also be a barrier for less affluent households.Given the better-than-expected industrial production data for October and the rejection of the most pessimistic retail sales scenarios, we still see potential for GDP growth in the fourth quarter of 2024 of around 3% YoY, compared to 2.7% YoY in the third quarter of this year and 2.7% for 2024 overall. We anticipate a rebound in the second growth engine, fixed investment, in 2025, which should allow economic growth to accelerate to 3.5% next year.More By This Author:FX Daily: New Season – Trump Tariff Show Asia Morning Bites For Tuesday, November 26Rates Spark: Downside Bias For Market Rates In Near-Term

Polish Retail Sales Partially Bounced Back In October