Soros Fund Places Big Bearish Bet on SPXÂ

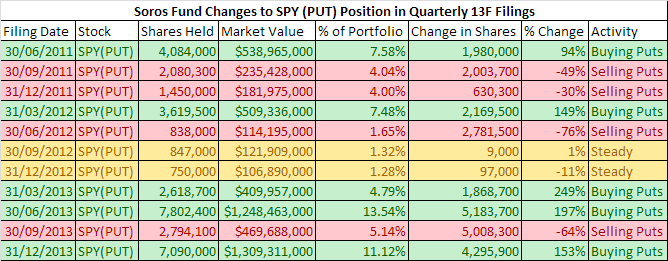

According to its latest publicly available filings, Soros Fund Management has increased its put position on the SPX (or rather, the SPX ETF SPY) to the second-highest level ever. Note that the fund seems to have held puts on SPY since at least the summer of 2011, and the position’s size is often adjusted, a sign that it has served as a hedge most of the time that is occasionally taken off and then increased again. What is noteworthy about the most recent filing (keep in mind that there is a 45 day delay involved as well, so this was the fund’s position at year end 2013) is that the position amounts to $1.3 billion and represents more than 11% of the total portfolio’s value. In other words, this was probably not merely a hedge, but rather an outright bet on a decline.

According to Marketwatch:

“Soros Fund Management has doubled up a bet that the S&P 500 is headed for a fall. Within Friday’s 13F filings news was the revelation that the firm, founded by legendary investor George Soros, increased a put position on the S&P 500 ETF SPY by a whopping 154% in the fourth quarter, compared with the third. (A put or short position basically gives the owner the right to sell a security at a set price for a limited time, and in making such a bet, an investor generally believes the security is going to decline.)

The value of that holding, the biggest position in the fund, has risen to $1.3 billion from around $470 million. It now makes up a 11.13% chunk of all reported holdings. It had been cut to 5.14% in the third quarter, from 13.54% in the second quarter, which itself marked another dramatic lift on the bearish call.â€

Here is a table showing how the put position has been adjusted over time:

Soros Fund Management’s holding of SPY puts over time.

Note that in spite of holding a very large position in SPY puts in the course of the bull market period, the fund has performed quite well – since 2011, its NAV has almost tripled. Here is a detailed list of its current holdings by sector.

Since the fund also added various long positions, it is almost certain that the large position in SPY puts is of a tactical nature. Given the recent decline, it is quite possible that it has been decreased in the meantime (just as it is possible that it has been increased again in the subsequent rebound). Still, it is a very large position and Soros is famed for at times taking outsized positions that turn into big winners.

Technical Backdrop

The comparison chart showing the similarity between the current chart pattern of the DJIA with that of the DJIA in 1929 that was first suggested by Tom DeMark many months ago, has been published so widely by now that it is almost certain that it won’t continue to hold up. Numerous equity strategists have rightly pointed out that such pattern comparisons rarely ‘work’, especially as the market and economic conditions accompanying the patterns are usually entirely different.