Apple knocked it out of the park!Â

Apple knocked it out of the park!Â

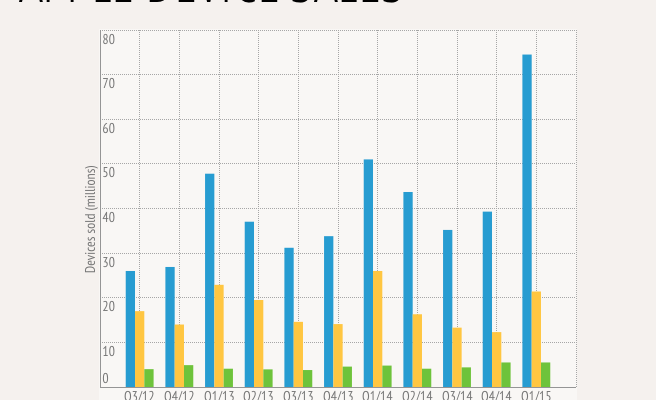

Last night, AAPL reported the most profitable quarter of any company in history – EVER!!! – making $18.04Bn in the last 3 months of 2014.  That’s $8.3M per hour in PROFIT with almost $1Bn/day in revenues ($74.6Bn for the quarter).  The company made $3.06 for each $109 share and that was already up 10% since last Q. Â

I’m sure NOW it is obvious why AAPL was our Trade of the Year in 2012 ($52 when we made that pick) as well as 2013 ($72) and again this December, even though it was alread hitting $110 after the split. Of course, we didn’t just play the stock at PSW, we played the options and our Top Trade Idea for Dec 17th was:

- 20 2017Â $90/120 bull call spreads at $13.50 ($27,000)

- 20 short 2017 $85 puts at $9.50 ($19,000)Â

Our 2013Â Trade of the Year is pictured on the left and made the full 614% expected and our 2014 Trade of the Year parlayed that money into the following:

Our 2013Â Trade of the Year is pictured on the left and made the full 614% expected and our 2014 Trade of the Year parlayed that money into the following:

- 10 2016 $450/600 bull call spreads at $65 ($65,000)

- 10 short 2016Â $450 puts for $41 ($41,000)

That trade is already 100% in the money and will make the full $126,000 (525%) if AAPL holds $85.72 (post split), which is why we were able to be be nice and aggressive with our 2015 Trade of the Year, going for another 650% if AAPL is over $120 in Jan 2017.  I know it sounds boring to keep picking AAPL for our top trade 3 years in a row but I don’t know a better, safer way that we could have made 614%, 525% and now 650% on our money 3 years in a row than betting on the fact that AAPL was severely undervalued by the market (here’s me on TV on 12/19 discussing the Apple trade). Â

We don’t ALWAYS pick AAPL – our 2012 Trade of the Year was BAC, which turned out to be the best-performing stock in the S&P (SPY) for 2012 and that option combination (all picked live on TV and, of course, in our Member Chat Room at www.Philstockworld.com) returned 350% so, had you taken an initial $5,000 and put it into our 4 consecutive trade ideas, it would look like this:

We don’t ALWAYS pick AAPL – our 2012 Trade of the Year was BAC, which turned out to be the best-performing stock in the S&P (SPY) for 2012 and that option combination (all picked live on TV and, of course, in our Member Chat Room at www.Philstockworld.com) returned 350% so, had you taken an initial $5,000 and put it into our 4 consecutive trade ideas, it would look like this: