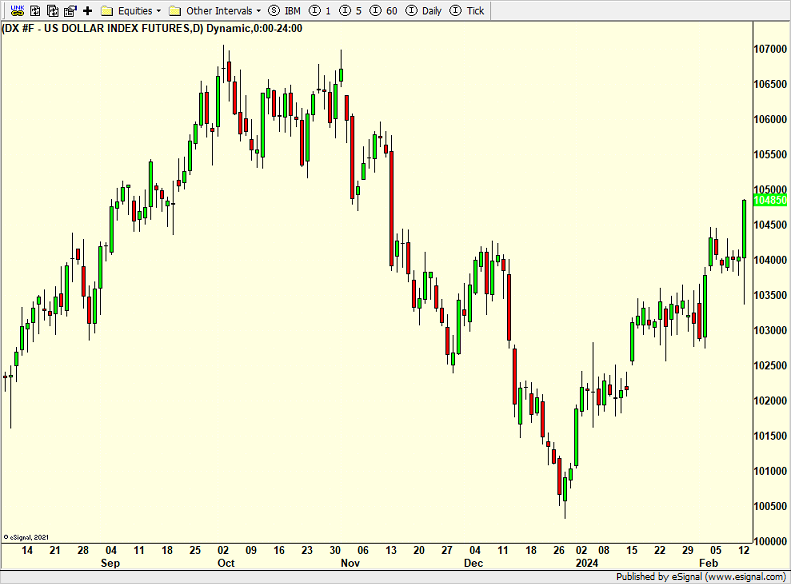

The markets had a little down day, eh? I like when people ask me why the markets “crashed” on Tuesday. I mean, stocks are up 20% since the October bottom and hadn’t had even a 2% decline in three months. And we see a single down day of 1-3% and people are all beared up. I want to say that I don’t get it, but I totally do. It’s investor psychology and behavioral finance.And let’s be crystal clear like the Caribbean Sea. The bull market is absolutely not over, not by a large stretch. It was a bad day. It was ugly. But it was one single day. You can barely make it out when looking at the past 14 months. And what did it really do? It gave back the previous four days of advances. Four whole days. I am not panicking.(Click on image to enlarge) Now, Tuesday’s action was a long time in the making. I have been warning about some greedy behavior. People were giddy. Stocks were frothy. I lost count how many times I said that late comers will be punished. And they will. It’s not over. But let’s not get too myopic. One down day certainly didn’t correct the excesses in the markets. That is going to take some time.From my I am looking for “risk on” weakness to wrap up in April or May, certainly by the time unofficial summer begins. I believe the stock market is in the process of making a peak. And unlike bottoms which are spikey and volatile, tops are more diffuse and tend to roll. I don’t believe this top will be major or one of significance.If you want to watch one single thing for signs, I would still keep an eye on the dollar. “Risk on” markets do not like a strong and rallying greenback in this environment. When the dollar rolls over and heads south, stock should get another good tailwind.(Click on image to enlarge)

Now, Tuesday’s action was a long time in the making. I have been warning about some greedy behavior. People were giddy. Stocks were frothy. I lost count how many times I said that late comers will be punished. And they will. It’s not over. But let’s not get too myopic. One down day certainly didn’t correct the excesses in the markets. That is going to take some time.From my I am looking for “risk on” weakness to wrap up in April or May, certainly by the time unofficial summer begins. I believe the stock market is in the process of making a peak. And unlike bottoms which are spikey and volatile, tops are more diffuse and tend to roll. I don’t believe this top will be major or one of significance.If you want to watch one single thing for signs, I would still keep an eye on the dollar. “Risk on” markets do not like a strong and rallying greenback in this environment. When the dollar rolls over and heads south, stock should get another good tailwind.(Click on image to enlarge) On Monday we bought , , , and . We sold some and some . On Tuesday we bought levered S&P 500 and more levered . We sold PMPIX, RYPMX, PCY, levered inverse S&P 500 and some DXHYX.More By This Author:

On Monday we bought , , , and . We sold some and some . On Tuesday we bought levered S&P 500 and more levered . We sold PMPIX, RYPMX, PCY, levered inverse S&P 500 and some DXHYX.More By This Author:

One Day Wonder Or The Start Of A Big Decline