Â

Â

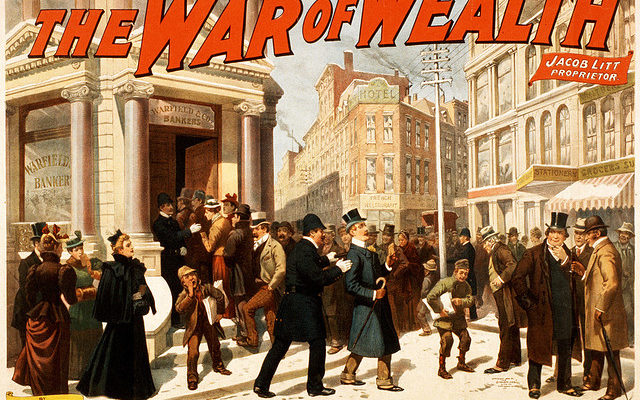

image credit: trialsanderrors

I can’t help but think after the financial crisis that we have drawn some wrong conclusions about systemic risk. Systemic risk is when the financial system as a whole threatens to fail, such that short-term obligations can’t be paid out in full. It is not a situation where only big entities fail — the critical factor is whether it creates a run on liquidity across the system as a whole.

Why does a bank fail? It can’t pay in full when there was a demand for liquidity in the short run. Typically, there is an asset-liability mismatch, with a lot of payments payable now, and assets that cannot be easily liquidated for what their stated value reported to the regulators.

Imagine the largest bank failing, and no one else. Yes, it would be a mess for the FDIC to clean up, but it could be done.  Stockholders and preferred stockholders get wiped out. Bondholders, junior bondholders, and large depositors take a haircut. Future deposit insurance premiums might have to rise, but there would be enough time to do that, with banks adjusting their prices so that they could afford it.

But banks don’t fail one at a time, except perhaps in good times with a really incompetently managed bank. Why do some banks tend to fail at the same time?

- They own many of the same debt securities, or same types of loans where the underlying asset values are falling.

- They own securities of other banks, or other deposit-taking institutions.

- Generalized panic.

What can stop a bank from failing? Adequate short-term cash flow from assets. Why don’t banks make sure that they always have more cash coming in than going out? That would be a lower profitability way of running a bank. It is almost always more profitable to borrow short and lend long, and make money on the natural term spread that exists — but that creates the very conditions that makes some banks run out of liquidity in a panic.