Scores of investors often regard Benjamin Graham as the grandfather of value investing. Even those who shun Graham’s methods of analyzing securities tend to revere quotes attributed to him. For example, on market complacency, “… chief losses to investors come from the purchase of low-quality securities at times of good business conditions.â€

In this discussion, we can assume that business conditions are relatively good. After all, over the last five years, corporations have refinanced their debts, boosted profit margins, strengthened their balanced sheets, increased productivity and avoided the costs associated with wage inflation. With respect to the quality of securities, investors have been mesmerized by stocks with high price-to-book and high price-to-earnings ratios, particularly shares of the companies that PowerShares NASDAQ Internet (PNQI) tracks.

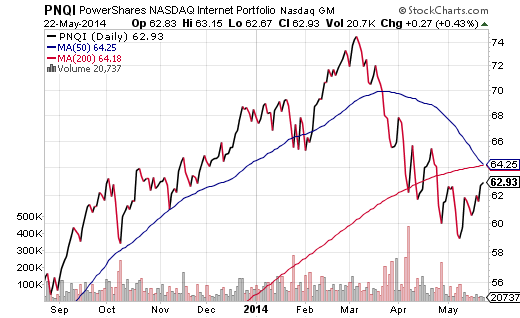

Not surprisingly to value-oriented investors, then, PNQI has fallen on rough times. The exchange-traded fund is roughly 15% off its all-time highs. That said, dip buyers may not be ready to throw in the ticker tape. PNQI has escaped bear market territory by rallying 6.5% off its May lows.

Whether you consider yourself a value investor, a growth investor or something else entirely, ignoring a wide range of damning evidence could be devastating to your wealth. From a technical perspective, PNQI’s 50-day moving average will cross below its 200-day moving average for the first time since the bearish summer of 2011. From a fundamental perspective, price-to-earnings data on prominent holdings like Netflix (NFLX), Priceline (PCLN) and Facebook (FB) epitomize 1999-style dot-com fervor.

So what makes more sense in an environment where business conditions are relatively firm, and where the U.S. Federal Reserve aims to be remarkably stimulative for many months into the foreseeable future? In the technology space, I continue to identify with First Trust Technology Dividend (TDIV). For starters, this fund’s price-to-earnings ratio (14.7) sits at a 15%-20% price discount to the broader S&P 500. Moreover, TDIV business more cash flow via its 2.7% SEC yield than ETF proxies for businessbenchmark. In addition, TDIV demonstrates remarkable relative strength compared to PNQI.