The NZD/USD pair has experienced a significant decline, touching a low of 0.5841 and reaching a yearly trough of 0.5796. The primary pressure comes from a robust US dollar, bolstered by anticipations of a more stringent tariff regime under US President-elect Donald Trump. Speculations about Trump imposing an additional 10% tariff on all Chinese goods have particularly impacted the Kiwi, given China’s role as New Zealand’s largest trading partner.The market pre-emptively reacts to potential US policy shifts, recalling Trump’s previous term characterised by aggressive trade policies. This has cast a long shadow over the NZD, influencing investor sentiment.The upcoming Reserve Bank of New Zealand (RBNZ) meeting on Wednesday is crucial, with expectations leaning towards a 50-basis-point rate cut to 4.25% per annum. This expected move aligns with the RBNZ’s dovish stance from October and could sustain the downward pressure on the NZD.Technical analysis of NZD/USD(Click on image to enlarge) H4 chart: the NZD/USD has completed a decline wave, reaching 0.5797, with a subsequent recovery phase targeting 0.5922 underway. After reaching this level, a potential pullback to 0.5860 could establish a consolidation zone around this marker. A break below this range might extend the decline to 0.5777, while an upward breach could pave the way to 0.5977.(Click on image to enlarge)

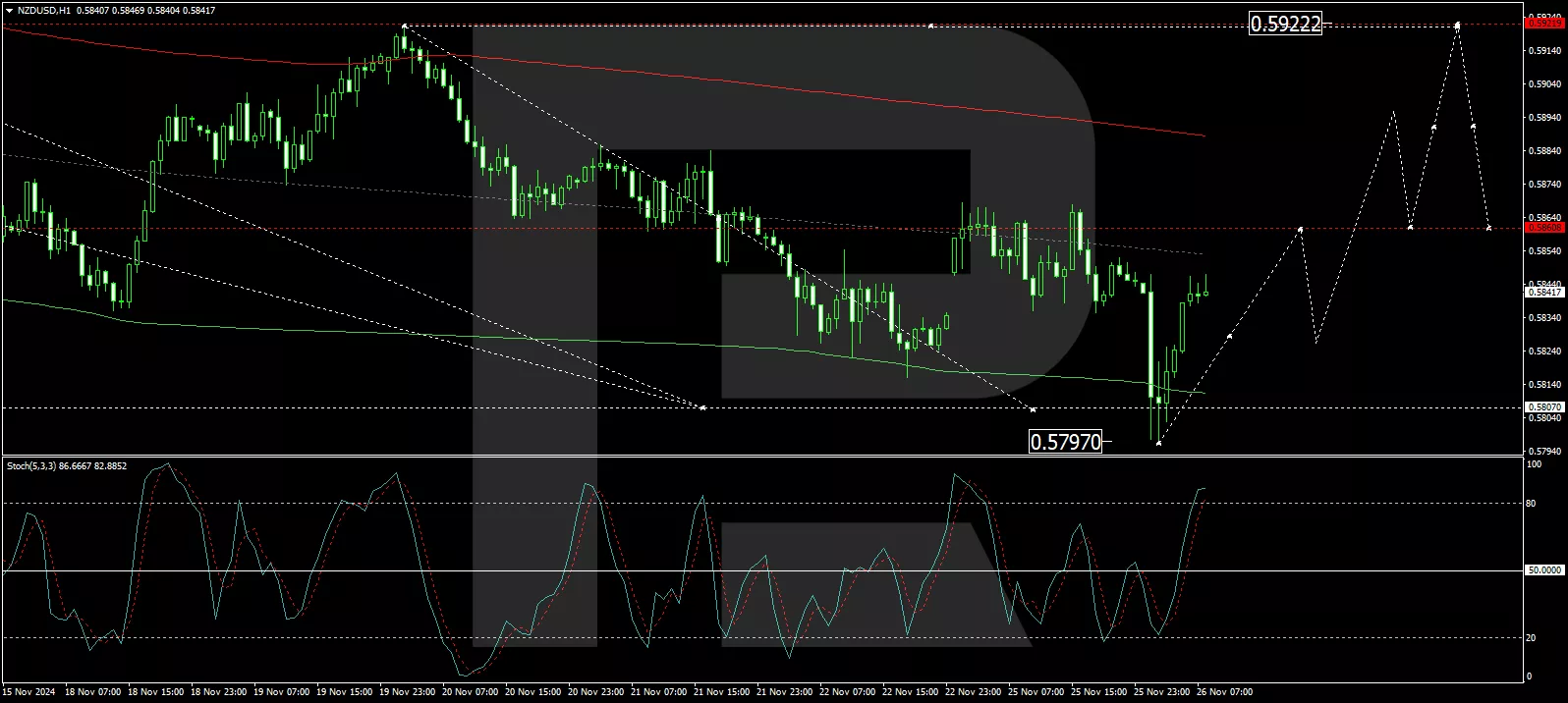

H4 chart: the NZD/USD has completed a decline wave, reaching 0.5797, with a subsequent recovery phase targeting 0.5922 underway. After reaching this level, a potential pullback to 0.5860 could establish a consolidation zone around this marker. A break below this range might extend the decline to 0.5777, while an upward breach could pave the way to 0.5977.(Click on image to enlarge) H1 chart: the pair is forming an initial growth wave towards 0.5860. Following this target, a retraction to 0.5828 is likely. The Stochastic oscillator supports this , indicating a possible downturn from elevated levels and enhancing the likelihood of continuing the downward trajectory.More By This Author:

H1 chart: the pair is forming an initial growth wave towards 0.5860. Following this target, a retraction to 0.5828 is likely. The Stochastic oscillator supports this , indicating a possible downturn from elevated levels and enhancing the likelihood of continuing the downward trajectory.More By This Author:

NZD/USD Hits Yearly Low Amid US Dollar Strength