The market certainly got off on the right foot last week, rallying all the way through Thursday when the NASDAQ Composite (COMP) finally cleared its all-time record high set back in March of 2000. With no other major market index completing the same feat though — in addition to Friday’s pullback somewhat extinguishing the budding rally – we can say right now that once again stocks are caught between a rock and a hard place.

We’ll dissect the details below, right after a quick run-down of last week’s and this week’s important economic news. Â

Economic Data

It was a fairly full week last week in terms of economic news, but only two really big ones.

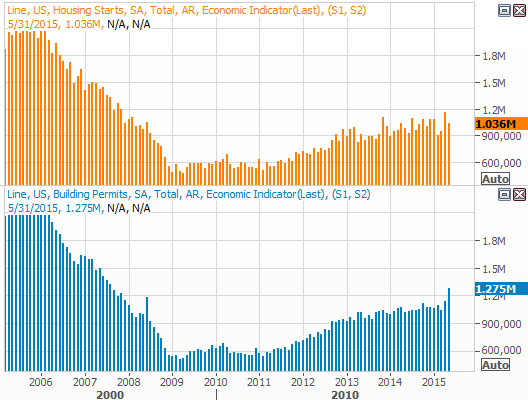

The fireworks started on Tuesday with May’s housing starts and building permits data. It was a mixed message. Starts fell from a pace of 1.165 million to 1.036 million, but permits ramped up from a pace of 1.140 million in April to 1.275 million last month. Either way, both are in long-term uptrends.Â

Housing Starts and Building Permits Chart

Source: Thomson Reuters

We also got an updated look at our inflation situation. Overall prices were up 0.4% last month compared to April’s prices, though on a core basis (not counting food or energy) consumer prices were up a mere 0.1%. On an annualized basis, the inflation rate now stands at 0.0%. On a core basis though, our annual inflation rate is a still-tepid 1.7%.

Inflation Chart

Source: Thomson Reuters

And of course, the Federal Reserve told us on Wednesday that though there would be no change to the current Fed funds rate of 0.25%, we could expect one at some point in the foreseeable future. September and December are the regularly scheduled times to make such a change if one (or two) becomes necessary. And, Janet Yellen believes economic growth and the unemployment situation are still both on a track that will prompt a rate hike sooner than later. All the same, Wednesday’s comments from the recent Fed meeting were ambiguous enough to leave all options open.Â