Since the end of the Great Recession, real estate investment trusts have been one of the hottest asset classes in the entire market.

Take National Retail Properties (NNN) as a perfect example.

Since bottoming out at $13 in October 2008, the stock has steadily rallied to its February 23 closing price of $45.37 per share.

Not only have share prices risen across the REIT space, but they have also rewarded investors with high dividend yields.

NNN has a 4% dividend yield. And, it is a Dividend Achiever, a group of 272 stocks with 10+ years of consecutive dividend increases.

You can see the full Dividend Achievers List here.

In the low interest rate environment, high-yield REITs with steady dividend growth—such as NNN—are in high demand.

While NNN stock no longer appears to be undervalued, investors can still count on reliable dividend growth for the foreseeable future.

Business Overview

NNN is a REIT that owns single-tenant, net-leased retail properties. Its properties are predominantly structured under long-term leases.

NNN’s properties include movie theaters, gas stations, fitness clubs, restaurants, and more. It is structured similarly to Realty Income (O), another high-quality REIT focusing on retail properties.

NNN owns more than 2,500 locations across 48 U.S. states.

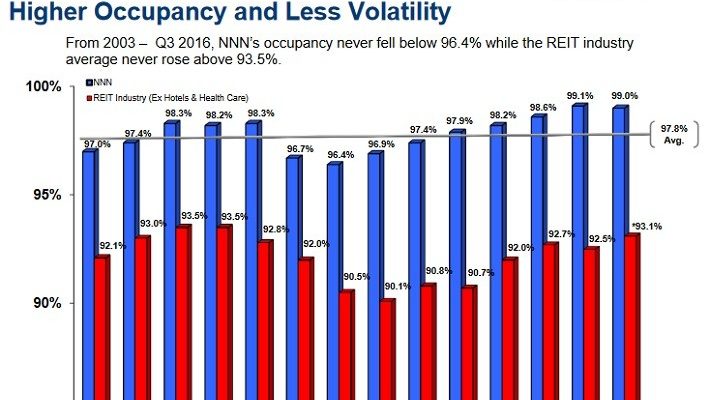

Its portfolio has an excellent occupancy rate of 99.1%. Since 2003, NNN’s occupancy never fell below 96.4%.

Source:Â Investor Presentation, page 13

NNN leases to more than 400 tenants in 38 different retail categories. Its largest tenants include:

- Sunoco: 5.5% of Base Rent

- Mister Car Wash: 4.2% of Base Rent

- LA Fitness: 3.9% of Base Rent

- Camping World: 3.4% of Base Rent

- Couche-Tard (Pantry): 3.4% of Base Rent

- 7-Eleven: 3.3% of Base Rent

- SunTrust: 3.1% of Base Rent

- AMC Theatre: 2.9% of Base Rent

It has chosen to focus on retail properties because it believes retail offers competitive advantages over a multi-property approach.