Income investors interested in buying real estate investment trusts, otherwise known as REITs, should pay particular attention to the health care REITs.

Health care REITs, such as National Health Investors (NHI), have a unique and compelling growth opportunity that sets them apart from other REITs—the aging U.S. population.

There are 76 million Baby Boomers in the U.S. As these individuals age, health care spending is likely to exceed GDP growth in the U.S. going forward.

NHI stands to capitalize from the trend, and investors will likely benefit from growing dividends. It recently increased its dividend. The stock currently offers a hefty 5% dividend yield.

Plus, it is a regular dividend grower. NHI is a Dividend Achiever, a group of 272 stocks with 10+ years of consecutive dividend increases.

This article will discuss why NHI has a positive growth outlook for the future, and why investors should consider it a solid dividend growth REIT.

Business Overview

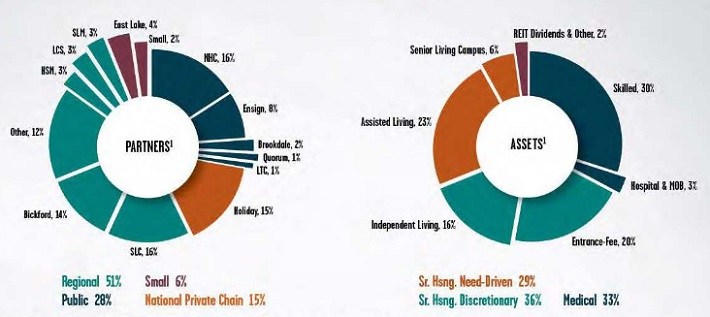

NHI specializes in senior housing and medical investments. It has a highly-diversified portfolio.

Its investments include a wide range of property types, including independent and assisted living communities, skilled nursing facilities, medical office buildings, and specialty hospitals.

(Click on image to enlarge)

Source:Â 4Q Supplemental Presentation, page 3

As of the end of 2016, NHI held 205 properties in its portfolio, spread across 32 U.S. states. The 205 properties are spread across the following types:

- Senior Housing: 129

- Skilled Nursing: 71

- Hospital: 3

- Medical Office: 2

The NHI portfolio occupancy averaged 91.8% for 2016.

High levels of demand for health care properties provide NHI with stable cash flows and the ability to raise rents over time.

And, the company’s high-quality properties have resulted in excellent growth rates in recent years.

NHI, like most REITs, reports its financial performance with funds from operation, or FFO, instead of earnings-per-share.