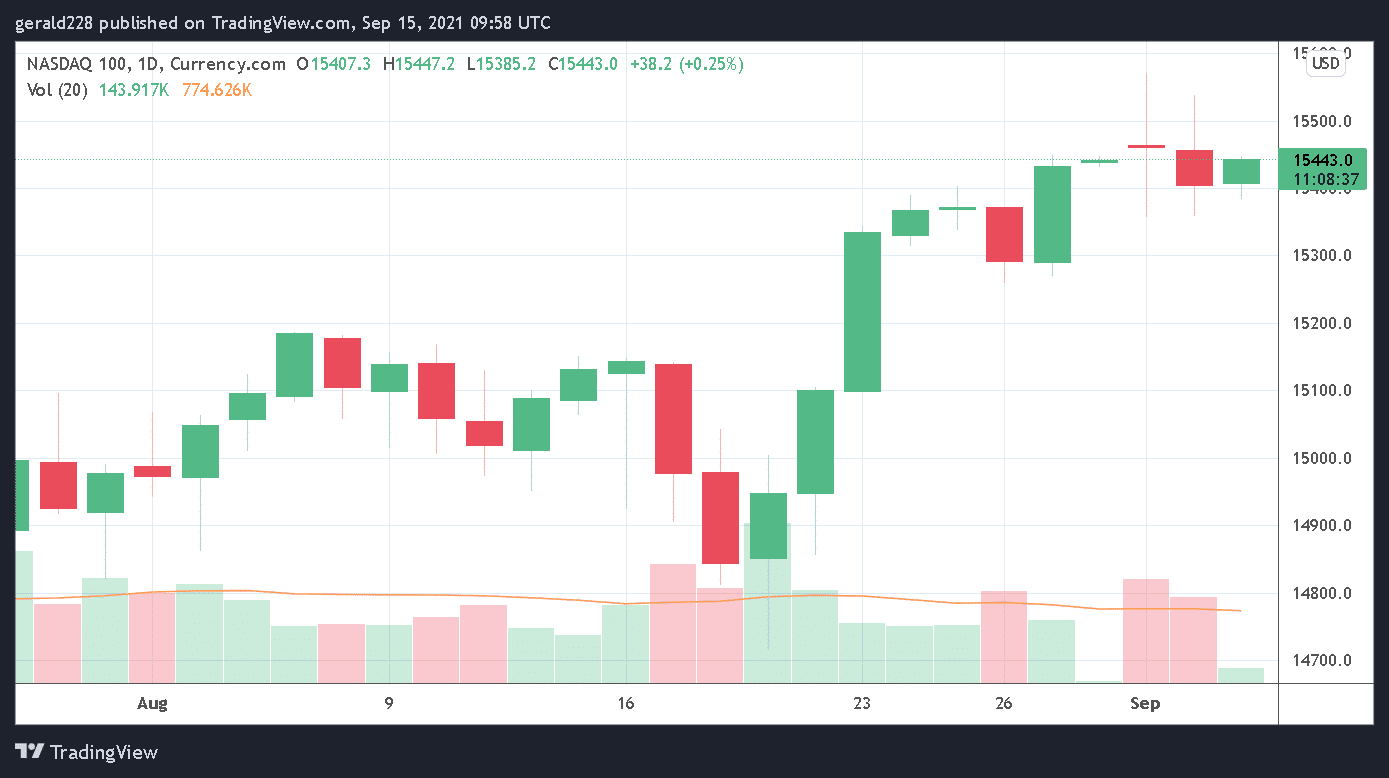

The NASDAQ price is up by a minuscle 0.35% after having dropped by almost 0.5% yesterday. This rise is no doubt due to US inflation figures showing a moderate increase with the Fed’s policy of caution before starting economic tapering vindicated. Yesterday’s launch of Apple’s new iPhone 13 also stole the show with tech stocks once again shining.Although Covid19 concerns remain, the Nasdaq price has continually been on a bullish streak with new ATH’s registered almost every week. Although inflation still remains a concern, the pace seems to have slowed, with an indication over when economic tapering is to begin expected soon.If you want to start trading forex, you should take a look at this Trading Forex For Beginner’s Guide.Short Term Prediction For Nasdaq Price: More Upside Expected The Nasdaq price is currently trading at the 15440 mark or around 120 points off its ATH of 15560 registered last week. There appears to be some momentum for recovery as relatively good inflation figures gave investors a lift. Analysts are generally expecting that the Nasdaq price will return to the 15500 level very soon.If a bullish thesis were to come into play, then the NASDAQ price will most likely return to the mid 15500 levels. Another push forward to the 15600 mark would not be unexpected if resistance is broken. Performance of tech companies such as Apple with their recent launch of new products could also be a boon to the index’s bullish prospects.If a bearish thesis were to play out, the NASDAQ price would likely revisit the 15400 level. If a sell off in stocks were to occur on the back of Covid19 concerns and sluggish vaccine distribution, the price could fall even further. However, this scenario looks quite unlikely at this stage.If you want to begin trading forex, then you should take a look at these Top Forex Brokers.Long Term Price Prediction For US100: Still Remains Considerable Bullish OverallAlthough there has been a recent hiccup for the Nasdaq price, the long-term expectations for it remain bullish. Much depends on the continued resurgence of the economy although hiccups such as the Afghanistan debacle remain. However, the NASDAQ is looking more bullish than the S&P500 mark and certainly much better than the DJ.With the US CPI figure done and dusted, the next key point for the Nasdaq price will be the September FOMC. Bullish indications remain however and the 16000 mark by the end of the year is not an unlikely prospect.Looking to trade forex now? Invest at eToro!67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

The Nasdaq price is currently trading at the 15440 mark or around 120 points off its ATH of 15560 registered last week. There appears to be some momentum for recovery as relatively good inflation figures gave investors a lift. Analysts are generally expecting that the Nasdaq price will return to the 15500 level very soon.If a bullish thesis were to come into play, then the NASDAQ price will most likely return to the mid 15500 levels. Another push forward to the 15600 mark would not be unexpected if resistance is broken. Performance of tech companies such as Apple with their recent launch of new products could also be a boon to the index’s bullish prospects.If a bearish thesis were to play out, the NASDAQ price would likely revisit the 15400 level. If a sell off in stocks were to occur on the back of Covid19 concerns and sluggish vaccine distribution, the price could fall even further. However, this scenario looks quite unlikely at this stage.If you want to begin trading forex, then you should take a look at these Top Forex Brokers.Long Term Price Prediction For US100: Still Remains Considerable Bullish OverallAlthough there has been a recent hiccup for the Nasdaq price, the long-term expectations for it remain bullish. Much depends on the continued resurgence of the economy although hiccups such as the Afghanistan debacle remain. However, the NASDAQ is looking more bullish than the S&P500 mark and certainly much better than the DJ.With the US CPI figure done and dusted, the next key point for the Nasdaq price will be the September FOMC. Bullish indications remain however and the 16000 mark by the end of the year is not an unlikely prospect.Looking to trade forex now? Invest at eToro!67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

NASDAQ Price Prediction: Back To Bullish After Inflation Fears Recede