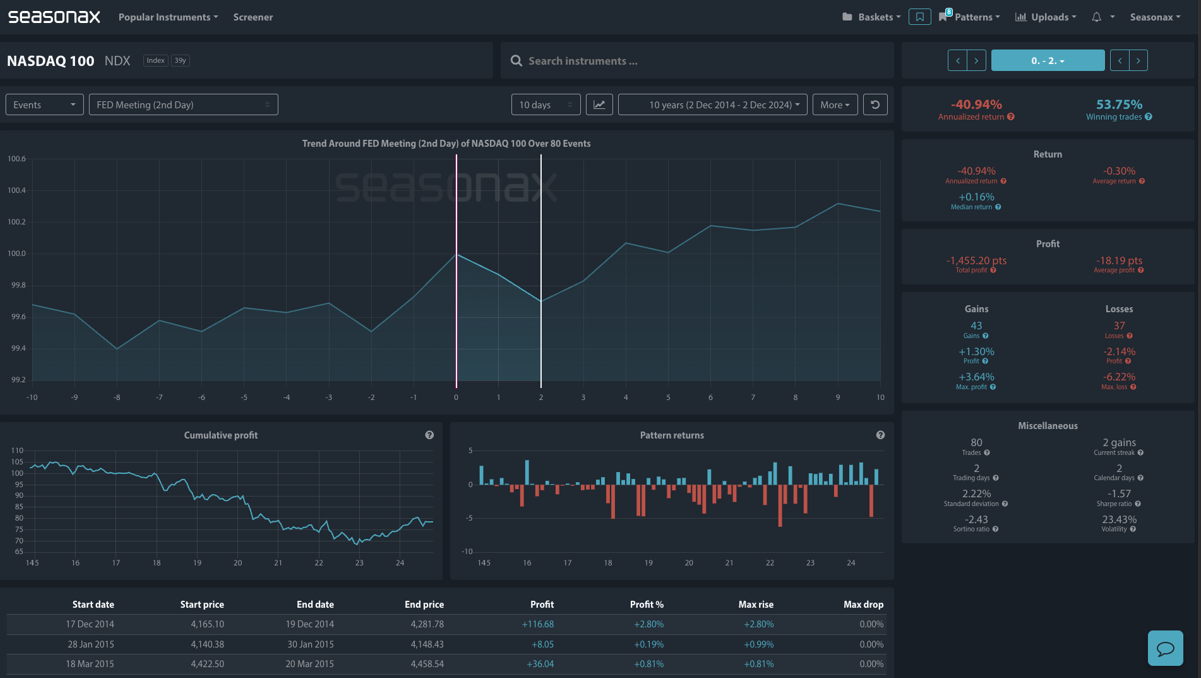

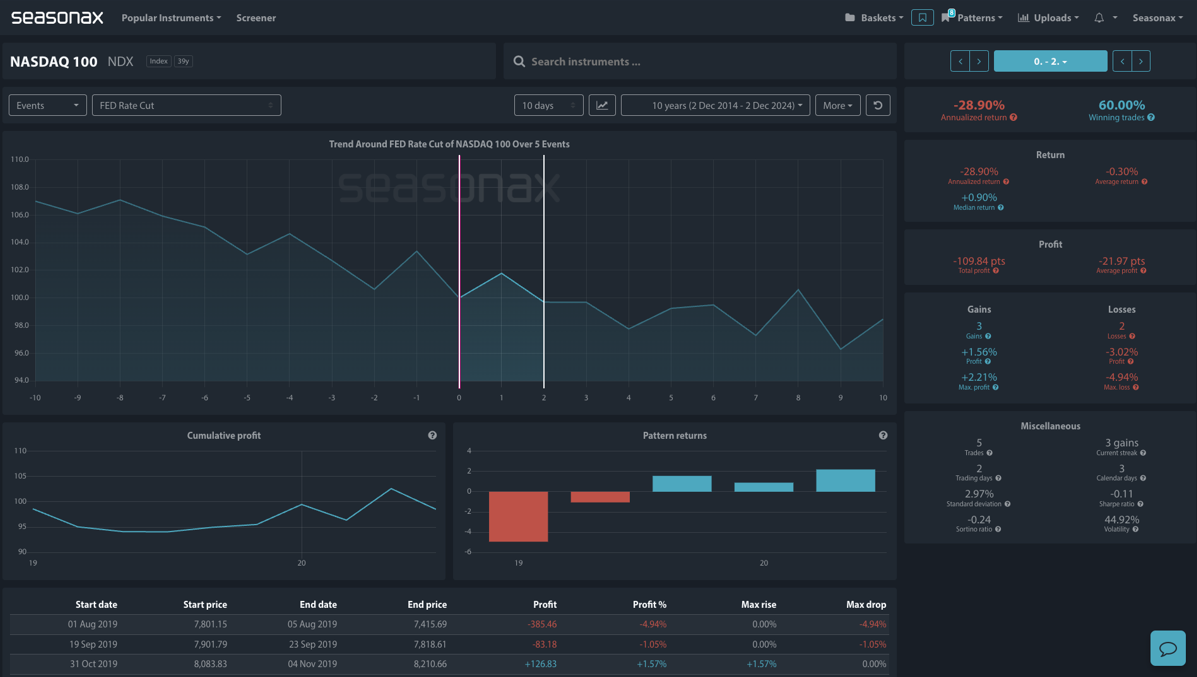

The Nasdaq is highly rate-sensitive due to its heavy concentration of technology and growth-oriented companies, which are valued primarily on their future earnings potential. When interest rates rise, the higher discount rate reduces the present value of these future earnings, compressing valuations and disproportionately affecting growth stocks. Additionally, many tech companies rely on borrowing to fund innovation, and rising rates increase their borrowing costs, squeezing margins. Higher rates also make fixed-income assets more attractive, prompting investors to rotate out of riskier equities like those in the Nasdaq. Moreover, tighter monetary policy often slows economic growth, reducing consumer and enterprise spending, which are critical for tech companies. These factors, combined with the Nasdaq’s inherent volatility, make it particularly sensitive to rate changes.The Nasdaq 100 exhibits a distinct pattern of performance around key Federal Reserve events, which can guide expectations for the December 18 Fed meeting. Data from past Fed meetings (second day of announcements) shows that the Nasdaq has an annualized return of -40.94%, with an average return of -0.30%. However, the win rate is 53.75%, suggesting mixed outcomes but a slight bias toward negative returns. Losses during this period have been more pronounced, with a maximum drawdown of -6.22%, indicating the index’s sensitivity to policy announcements.(Click on image to enlarge) In comparison, Fed rate cuts present slightly better dynamics for the Nasdaq, with an annualized return of -28.90% and a 60% win rate. However, the average return remains negative (-0.30%), indicating that while rate cuts often buoy markets in the short term, they do not guarantee sustained Nasdaq gains, especially if cuts are perceived as reactive to economic weakness. Volatility is significant, with a standard deviation of 2.97% during rate cut announcements.(Click on image to enlarge)

In comparison, Fed rate cuts present slightly better dynamics for the Nasdaq, with an annualized return of -28.90% and a 60% win rate. However, the average return remains negative (-0.30%), indicating that while rate cuts often buoy markets in the short term, they do not guarantee sustained Nasdaq gains, especially if cuts are perceived as reactive to economic weakness. Volatility is significant, with a standard deviation of 2.97% during rate cut announcements.(Click on image to enlarge) Trade risks

Trade risks

Previous seasonal patterns do not guarantee future seasonal moves.Video Length: 00:03:05More By This Author:WTI Crude Oil’s Seasonal Strength Meets OPEC+ ChallengesSeasonal Strength: Dax’s Strong Year-End Rally Will NFP Increase The Case For A December Fed Rate Cut

Nasdaq And The Fed: Key Insights For December 18