Vaporization in Bitcoin-Land

It is still not quite clear what exactly happened at Mt. Gox in Tokyo, the formerly biggest bitcoin exchange in the world. According to the exchange, the so-called ‘transaction malleability’ problem allowed hackers to initiate countless bogus transaction, stealing some 744,000 bitcoins. Even at the recently somewhat lower price of $600 per bitcoin (at non-Mt. Gox exchanges), this sounds like a lot of money. In fact, it sounds as if the exchange has essentially been bankrupted/vaporized, and no amount of ‘trying to fix the problem’ can actually, well, fix it. Mind, this is just a hunch on our part based on the fact that about $450 m. are said to have disappeared.

In spite of no longer allowing withdrawals (whether of bitcoin or any other forms of currency) since February 7, trading actually continued at Mt. Gox until February 25. During that time, bitcoin prices crashed on the exchange, and a two-tier price system developed. There have always been slight price differences between the various bitcoin exchanges, but our impression was that arbitrage transactions kept prices at most exchanges for the most part quite closely aligned. However, after it became clear that withdrawals from Mt. Gox were no longer possible, the price of bitcoin traded there decoupled rather noticeably. While the currency weakened at other exchanges as well, it did so to a far smaller extent.

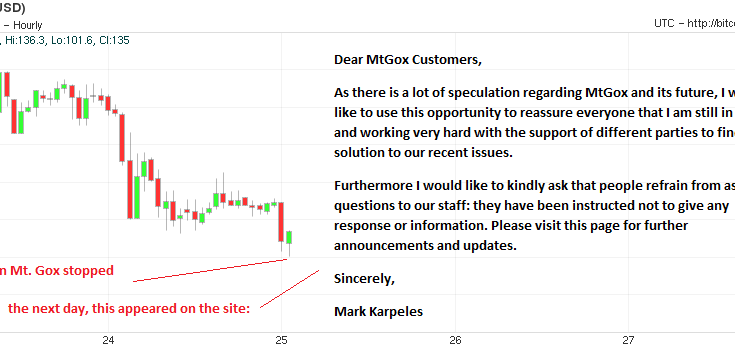

This week, trading at Mt. Gox finally stopped and the site became inaccessible shortly thereafter. Access has beenrestored in the meantime, but all the site does at resent is display the terse message that can be seen on the chart below:

The final hours of trading at Mt. Gox. Bitcoin had crashed to a mere $130 at the exchange, almost a 90% decline from last year’s high. The above message from its CEO Mark Karpeles has been displayed since trading was halted – click to enlarge.

Given other news that are making the rounds in the meantime (see further below), our advice to Mr. Kerpeles would be to better call Saul.