“Davidson: submits:

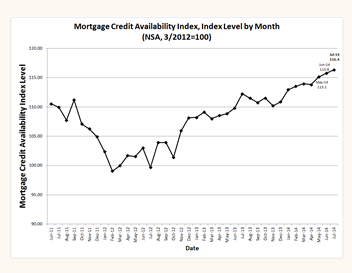

The MCAI(Mortgage Credit Availability Index) is a new index designed by the Mtg Bankers Assoc to measure the availability of home mortgages to home buyers. While this index currently shows an uptrend, the level today 116.4 (see 1st chart) remains well, well below the peak of ~875 (see 2nd chart) reached in March 2006 during the lending build-up to the sub-prime crises.

I encourage you to visit the site and read the latest release.

There has been considerable media chatter about rising home prices and lending being in another bubble with numerous forecasts for 30%-50% stock market collapses likely in the months ahead. The reasons offered are based on perceptions of excessive lending to the housing market which in turn has become over priced. I disagree!! Housing has only recovered to 2006 pricing levels for the most part and this is not terribly over valued if one considers that prices today are where they were 8yrs ago.

Lending has remained nearly as tight today as it was in 2012. We are so far below the 2006 period of excess that lending could double or triple from current levels and still not be excessive. New home building is in the ~600,000 units per year range when historically the average the past 60yrs has been ~1,200,000 units per year. Housing construction still has a long way to go before we return to historical averages. If you have not noticed, we are now in the range of 318mil in population growing at ~1% each year and demand for certain level of housing has only grown over the decades.

My take on the Fed is that its attempt to keep mtg rates low to spur housing has had entirely an opposite effect. This is because low mtg rates mean low bank profits while the costs of meeting regulatory costs have roughly doubled from $35bil to $70bil estimated (for the top 6 banks) in a recent Wall Street Jnl article. Before banks can expand lending, they require higher mtg rates(wider credit spreads) to cover operating costs, regulatory costs, build a reserve against future defaults  and make a profit. This is why I have stressed that wider credit spreads will lead to broader bank lending and economic expansion. We should all cheer for higher 10yr Treasury rates on which mtg rates are based.

Bank lending remains very tight due to Fed and regulatory activity, but it is improving. Higher mtg rates should see a more active home building market, higher employment, additional economic expansion and higher equity markets.