The seemingly incessant strengthening trend of the Chinese Yuan (much as with the seemingly inexorable rise of US equities or home prices) has encouraged huge amounts of structured products to be created over the past few years enabling traders to position for more of the same in increasingly levered ways. That was all going great until the last few weeks which has seen China enter the currency wars (as we explained here). The problem, among many facing China, is that these structured products will face major losses and as Morgan Stanley warns “real pain will come if CNY stays above these levels,” leading to further capital withdrawal, illiquidity, and a potential vicious circle as it appears the PBOC is trying to break the virtuous carry trade that has fueled so much of its bubble economy.

Deutsche Bank notes that Chinese equities yesterday hit 1 month lows and are 65% off the all time highs. There’s a mix of reasons but one of the biggest stories of the past week or so has been the depreciation of the Chinese currency, both onshore where USDCNY is up 1.0% over the past week and offshore where USDCNH is up 1.25%.

Whilst these moves may not seem large in the context of other EM currencies, they are significant compared to the usual size of Renminbi moves.

PBOC is trying to break the virtuous carry trade that has fueled so much of its bubble economy Deutsche adds that whilst there has been some weak Chinese data which might explain part of the depreciation, the broad feeling is that this move has been driven by efforts by the PBOC to shakeout the large long Renminbi carry trade that has been built on the back of the view that the Chinese currency can only appreciate in value.

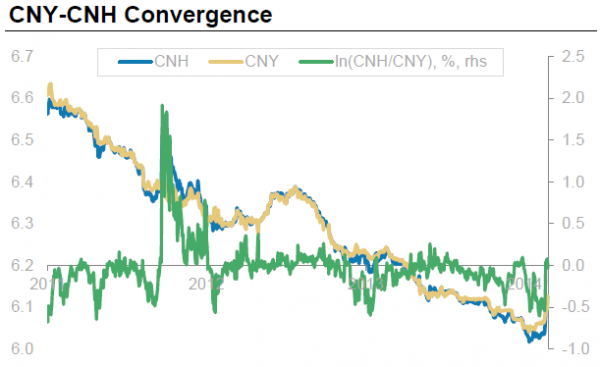

Indeed worries at the PBOC may have been triggered by one sign of this carry trade in action – the premium with which offshore USDCNH has been trading over the tightly controlled onshore USDCNY value over the course of 2014. This premium has now largely disappeared.

The total size of the carry trade is hard to estimate although even just looking at some of the onshore CNY positions accumulated, DB Asia FX strategist Perry Kojodjojo estimates that corporate USD/CNY short positions are around $500bn. The size of the carry trade and the fact that China saw significant capital outflows during the last period of substantial Renminbi depreciation in the summer of 2012 has led to concerns over what this might mean for both the Chinese economy and financial markets as well as broader global financial implications.