Morgan Stanley stock is 3.5% higher after reporting another “stellar”, as Bloomberg called it, quarter with beats across the board, especially in trading and investment banking, in contrast to Goldman’s somewhat soft earnings report.Â

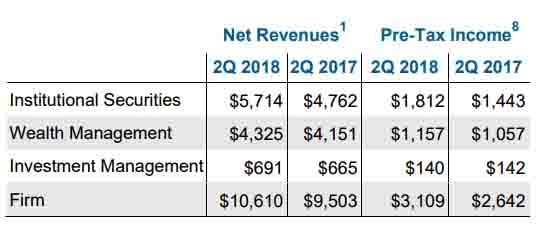

The bank reported Q2 EPS of $1.30, handily beating estimates of $1.11, on revenue of $10.6BN, half a billion above the $10.1BN expected, and compared to $9.5BN a year ago.

Morgan Stanley reported that its effective tax rate from continuing operations was 20.6% in Q2, in line with that of Goldman and somewhat higher than expected, reflecting “the impact of intermittent net discrete tax benefits of $88 million primarily associated with new information pertaining to the resolution of multi-jurisdiction tax examinations and other matters

This was the second consecutive quarter in which Morgan Stanley reported over $10BN in revenue, as well as the 13th consecutive quarter in which Morgan Stanley reported higher revenues than Goldman.

Â

Commenting on the result, CEO James Gorman said, “We reported robust revenue and earnings growth this quarter with strength across all businesses and geographies. The second quarter performance reflected active markets and healthy client engagement. Our strong global franchise positions us well to continue to grow organically across each of our businesses and to deliver operating leverage.”

More importantly, unlike Goldman, there were no complaints about a lack of market volatility during the quarter.

The revenue beat was solid and carried across all key investment banking product lines:

- Investment banking revenue $1.7BN vs $1.4BN y/y, with advisory rev. of $618MM vs $504MM on higher levels of completed M&A activity across all regions.

- Equity underwriting rev. $541MM vs $405MM y/y driven, like in Goldman’s case, by higher revenues on IPOs.

- Fixed income underwriting revenues of $540MM vs $504MM, driven by junk bond loan fees.