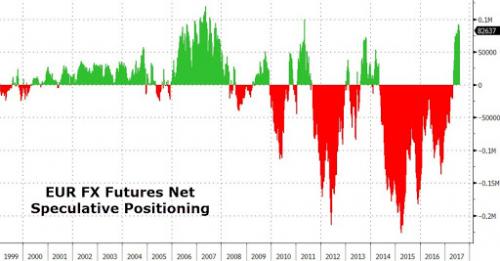

In Morgan Stanley’s “Sunday Start” note, the bank’s chief European economist, Elga Bartsch, looks at the recently surging EUR, where net spec positioning remains near the most bullish level in the past 6 years…

… notes that according to the bank’s currency expects, the “bull case of 1.28 for EUR/USD looks increasingly likely”, but wonder “at what point a bit of breathlessness could turn into outright altitude sickness.“

Here is MS’ latest take on “what’s next in global macro” with a focus on the common currency.

Climbing Mountains or Walking Hills

You don’t have to climb one of the mountain peaks in the Alps to feel a bit breathless this summer. Watching the euro climb further might already suffice if you are an investor. And we might not be near the peak yet. According to our currency experts, their bull case of 1.28 for EUR/USD looks increasingly likely, even with Friday’s relatively solid US employment report. Investors will therefore be wondering at what point a bit of breathlessness could turn into outright altitude sickness. For now, the ECB seems unconcerned about the strength of the euro, largely because it is reflecting stronger economic fundamentals and better prospects for political reforms. While it is clear that the euro area economy has shifted into higher gear, it remains to be seen whether reforms will able to make a quantum leap.

This past week, the euro area economy put in three back-to-back quarters of above 2%Q SAAR GDP growth. In response, we raised our euro area GDP growth forecast to 2.1%Y for 2017 and 1.8%Y for 2018, 20bp higher for each year. An average growth rate of 2.25%Q SAAR since last autumn might not seem much for some of our readers, but on the ‘Old Continent’ this pace sits a full percentage point above potential growth. As a result unemployment keeps falling faster than many forecasters, including us and the ECB, expected. At 9.1% of the labor force, unemployment remains above the pre-crisis level of around 7%. But it is not very far above most estimates of the natural unemployment rate. While inflation pressures remain subdued, core inflation inched further above 1%Y in July. At 1.2%Y, it now stands half a percentage point above its March low.