Family Dollar stores have been a Wall Street darling for over a decade. Its stock rose from $5 in the late 1990s to $77 in the last year. It has sales of over $10 billion and operates 8,100 stores in 46 states and employs over 34,000 full time employees. It is the canary in the coal mine for lower income and middle income families in this country. Based on their latest earnings report, the canary has a terminal disease. During the quarter where they do there biggest business, they saw their revenue plunge by $170 million, with same store sales down 3.8%. Their profit COLLAPSED by 35% over the prior year. Their results were a fucking disaster. They are so optimistic about the future that they have decided to close 370 stores. That’s a sure sign of economic recovery. Right?

While the stock market soars to new heights through the magic of HFT front running by the Wall Street shysters, the real people in the real world have run out of money to spend at dollar stores. I guess the new hot retailer will be the Family Dime Store. Oh yeah. We had those back in the 1960s and 1970s before the Federal Reserve destroyed another 80% of our purchasing power with that non-existent inflation.

Observe what is happening. Don’t listen to what they are saying.

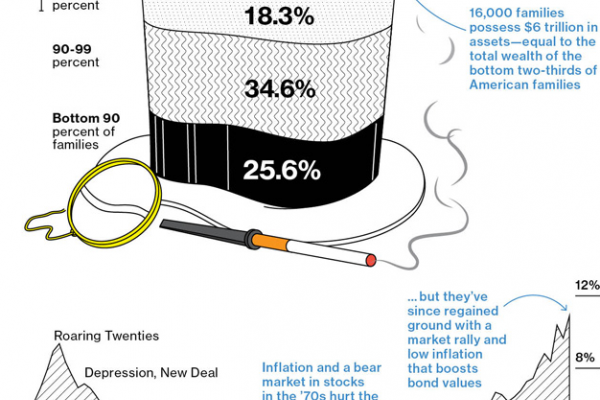

Does this chart explain anything?

Family Dollar shares fall after earnings miss

NEW YORK (MarketWatch) – Family Dollar Stores Inc. (NYSE:FDO) reported its fiscal second-quarter profit fell to $90.9 million, or 80 cents a share, from $140.1 million, or $1.21 a share, a year earlier. Revenue fell to $2.72 billion, from $2.89 billion a year earlier, the discount retailer said Thursday. Analysts had expected earnings of 90 cents a share on revenue of $2.77 billion, according to FactSet. Same-store sales were down 3.8% last quarter. “Our second quarter results did not meet our expectations,†said Chairman and CEO Howard Levine, noting that the holiday season proved particularly challenging. Family Dollar said it is closing about 370 under-performing stores. The retailer expects a per-share earningsrange for the current quarter of $0.85 to $0.95, which excludes restructuring charges. For the full year, the firm expects an earnings per share range of $3.05 to $3.25. Shares in Family Dollar were down 1.8% in premarket trading.