What a busy weekend!Â

We finished part 3 of our Merry May Trade Review and it was merry indeed with 31 of 37 trade ideas coming up winners in week 3, giving us a total of 125 wins and 17 losses (88%) for the first 3 weeks of the month.  Needless to say, we were generally bullish but some of our bull misses, like ABX, CLF, FCX are exactly the kind of trades we should be looking at as new entries – if this rally is going to continue.Â

We also updated Big Chart’s Must Hold Levels this morning to a more aggressive zone in our latest installment of “Charts from the Future.”  While we are still rally-skeptical, we’re not going to fight the Fed from a TA perspective – we’re simply moving up the lines which will tell us to get more bearish – just in case the market ever does head lower again (doesn’t seem like it will happen with the VIX at 10.85, does it?).Â

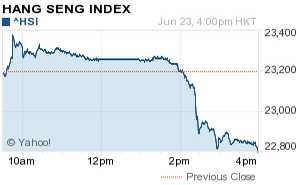

Meanwhile, the chart of the day is the Hang Seng, which fell off a cliff at 2pm (2am, EST) as China’s Beige Book showed the economic slowdown deepening in Q2.  Capital spending showed weakness and fewer companies applied for credit with the slowdown hurt hiring and wages, and interest rates offered by shadow lenders fell below levels offered by banks.

“Since investment has been the engine of the economy for the past seven years, this weakness has sweeping effects on sectors, regions and gauges of firm performance.  Overinvestment has been an addiction and withdrawal symptoms will not be pretty.â€

For the first time since the China Beige Book survey began in 2012, no sector showed an improvement compared with the previous quarter, according to today’s report. Transportation, mining and retail slowed andservices weakened more sharply.  The survey showed “dramatic differences†between parts of the real estate industry, with commercial and residential realty “pummeled while construction held up fairly well,†China Beige Book said.Â