Brexit, the official withdrawal of the United Kingdom from the European Union, kicked off on March 29, 2017, with two years set to “B-Day†on March 29, 2019. Over 50% of the British public voted to leave the EU in a referendum with a turnout exceeding 72%. But could this move affect the financial markets in Europe?

There were hardly any smiles on European faces when the UK decided to extricate itself from the European Union. Indeed, when you think that just under 50% of the British electorate were also against the idea, then you would probably be quite amazed that the divorce is going ahead. But it is, and with less than one year until the official separation, there are more questions around than answers.

One key uncertainty is the effect that Brexit will have on both European and British financial markets. Traditionally joined at the hip, the financial exchanges of the UK, France, Germany, and Spain have traded in each other’s pockets for years, and the idea of a forced separation seemed quite unlikely.

But the divorce is going ahead and at full steam. The real issue is that nobody, most of all the Brits, even know what a post-Brexit Europe will look like. Talk of customs unions and soft and hard borders fill the news, but it is far from clear what this all means.

When it comes to financial clout, it would appear that Europe, with its larger population and greater territorial integrity, would have the game won. However, that may not be the case. For over 200 years, the London Stock Exchange has been the major counterpoint to international trading, matching the volumes and importance of the financial exchanges of North America. London’s “Square Mile†maintained a far greater influence on financial affairs that could be expected from its physical size.

Recent European regulation, in the form of the Markets in Financial Instruments Directive, or MiFID, sought to level the playing field between investors across Europe, including, at the time the initiative was set up, the United Kingdom. However, now, with separation drawing closer every day, the MiFID Officials in Paris and Brussels are worried. One particular effect that concerns them is the quotation spread between share bids and offers.

Traditionally, when a market maker trades in shares, the wider the margin between his buy and sell prices the less liquid that market becomes. Due to its prominence in the world of financial activity, the UK market could force the tightest spreads possible, encouraging investors away from Europe, where spreads were relatively greater. Spread sizes are generally based on the average daily volume of transactions on the most liquid market in the EU, and, for decades, that market had been in London.

There is a real chance that MiFID 2, the current version of the European financial markets initiative, will be revised to plug loopholes that give the Brits advantages in share trading. Of course, this MiFID 2.1 would be done “for the sake of greater transparencyâ€. A current consultation on the matter is set for a decision on September 7, 2018, when any new rules will be announced.

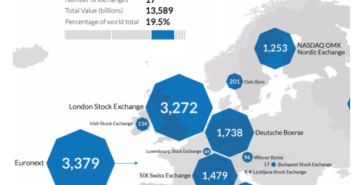

Major Stock Exchanges in Europe by Size

Source: http://money.visualcapitalist.com