Image: Bigstock

Image: Bigstock

MicroStrategy Company Overview

MicroStrategy Incorporated ( – ) is a software firm that focuses on business intelligence (BI) and analytics solutions. It offers a platform that empowers businesses to analyze and present their data for making decisions. Its tools support data exploration, interactive dashboards, data visualization, and reporting functions. Before going public in 1988, MicroStrategy secured fast food juggernaut McDonald’s Corporation ( – ) as a major client.

MicroStrategy Adopts the Bitcoin Standard

For years, MicroStrategy Chairman (and former CEO) Michael Saylor had been concerned that the monetary system has been expanding by ~7% per year while inflation has risen at a clip of ~2% annually. After conducting an extensive Bitcoin deep dive, Michael Saylor took the unprecedented and creative steps to adopt the “Bitcoin Standard.”During an interview, Saylor reasoned, “What we were doing was that we were inverting the balance sheet such that we’re floating on a Bitcoin sail, on a crypto sail, if you will, and as the liquidity and the monetary system gets pumped, we want it to float, rather than sink on that pool of liquidity.” Today, MicroStrategy holds over $15 billion in Bitcoin, making it one of the world’s top holders.

Bitcoin Catalysts

Since adopting the Bitcoin Standard, MicroStrategy has morphed from a software firm to a leveraged Bitcoin proxy. As such, to understand where the stock is going, one must first understand where Bitcoin is going. Below are four bullish Bitcoin catalysts.

1. Bitcoin Seasonality & “Uptober”

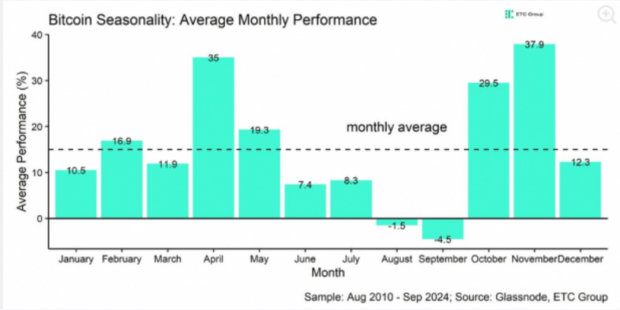

Historically, the fall has been the best time to be long Bitcoin. Since 2010, October has averaged a robust 29.5%, and November has averaged 37.9%. Image Source: Glassnode, ETC Group

Image Source: Glassnode, ETC Group

2. FTX Repayments

The FTX crypto exchange collapsed in 2022 after a brutal “crypto winter.” However, in a twist of fate, Bitcoin and most crypto assets have appreciated handsomely since then, and customers may be made whole to the tune of $16 billion in December. Many of these crypto enthusiasts will likely reinvest their money in Bitcoin, driving the price higher.

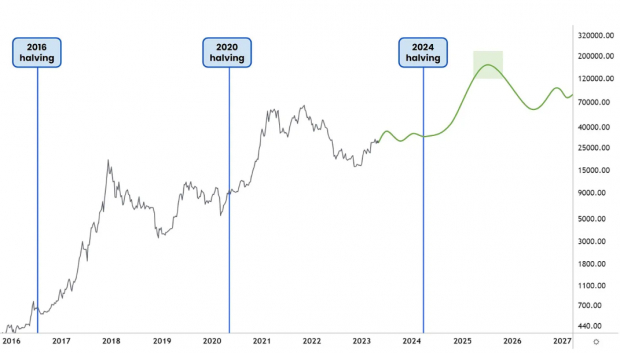

3. The Bitcoin Halving

The Bitcoin halving occurs every four years and reduces the reward for mining new Bitcoin in half. Previous Bitcoin halvings have led to triple-digit gains one year later. Though Bitcoin has been relatively flat since its last halving in April, history is on the side of the bulls. Image Source: TradingView

Image Source: TradingView

4. Bitcoin ETFs

Several Spot Bitcoin ETFs, such as the Fidelity Wise Origin Bitcoin ETF ( – ), Ark 21Shares Bitcoin ETF ( – ), and WisdomTree Bitcoin Fund ( – ), were approved in 2024. These ETFs should further enhance adoption among money managers and retail investors who do not have crypto accounts.Meanwhile, the iShares Bitcoin ETF ( – ), one of the most successful ETFs ever launched, will allow traders to trade options.

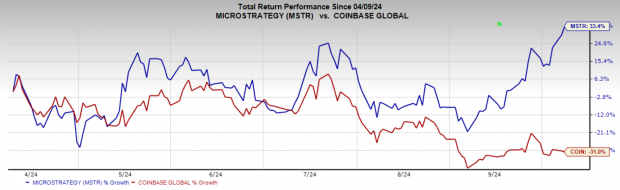

MicroStrategy’s Relative Strength

MicroStrategy’s stock printed fresh 52-week highs on Friday as volume swelled. Not only is MicroStrategy strong relative to Bitcoin, but the stock has also been exhibiting relative strength versus other crypto proxies, such as Coinbase Global ( – ). Image Source: Zacks Investment ResearchFurthermore, as the old Wall Street adage goes, “The longer the base, the higher in space.” MicroStrategy appears to be emerging from a seven-month base structure.

Image Source: Zacks Investment ResearchFurthermore, as the old Wall Street adage goes, “The longer the base, the higher in space.” MicroStrategy appears to be emerging from a seven-month base structure. Image Source: TradingView

Image Source: TradingView

Bottom Line

Bitcoin has several bullish catalysts that may send it higher. MicroStrategy could be the best way to be involved in a potential Bitcoin breakout.More By This Author:Bear Of The Day: Delta Air LinesBear Of The Day: American Airlines Bull Of The Day: Inuitive Surgical

MicroStrategy Breaks Out: Time To Buy The Bitcoin Proxy?