Priced in gold and stocks, wheat is near multi-decade lows. That may not last.

Measuring the cost of anything in currency can be misleading. As we know, inflation can be gamed by authorities to appear low, and supposedly low inflation is actually high inflation if wages are declining while prices rise.

Longtime correspondent Harun I. has often recommended in these pages that we look to other yardsticks to get a more realistic assessment of price and value.

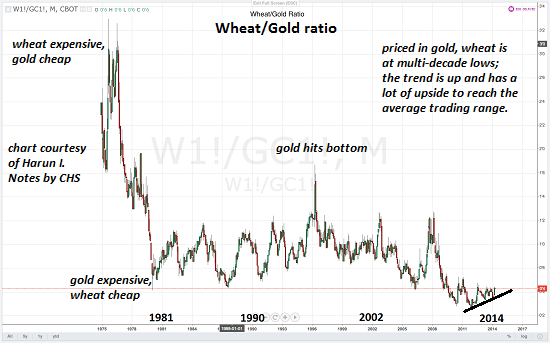

For example, what is the cost of wheat when priced in gold rather than dollars? Harun has graciously provided a chart of the wheat/gold ratio, which I marked up to identify when gold was expensive and wheat was cheap, and vice versa.

Priced in gold, wheat is at multi-decade lows; technically, this long downtrend appears to have reversed into an uptrend. If this is so, the only direction in the price of wheat (priced in gold) is up.

Here is wheat priced in the Dow Jones Industrial Average (DJIA). In essence, how many bushels of wheat can be purchased with one share of the Dow index?

In 1975, at the nadir of the stagflation-ridden stock market, wheat was expensive and the Dow cheap–once again, this is pricing wheat in the Dow, not the dollar.

At the top of the stock market bubble in 2000, the Dow was expensive and wheat was cheap.

When the Dow hit bottom in March 2009, wheat went up when priced in stock market shares.

Despite some impressive volatility since 2000, the trend in the price of wheat (when priced in stocks) is clearly up. Once again, it seems a long-term downtrend in the price of wheat has reversed and is now an uptrend.

The only way for wheat to regain its previous trading range is for gold and the Dow to both plummet or for wheat to rise in cost, i.e. it takes more gold or shares of the Dow to buy a bushel of wheat.

Priced in gold and stocks, wheat is near multi-decade lows. That may not last.Technically the trend has reversed, suggesting much higher prices–in dollars, gold or stocks–for wheat and indeed, by extension, for all food.

We may be tasting the first minimal increases in food prices that could soar to unimagined heights in the years ahead.