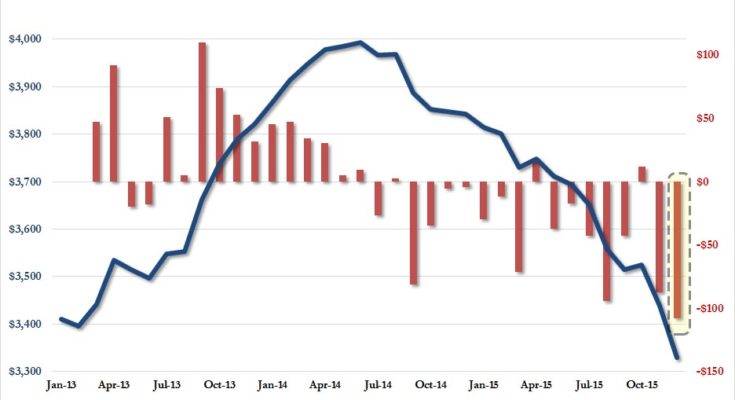

On Thursday, as the world was focusing on the collapsing Chinese exchange rate, we noted that in a more troubling development in December Chinese FX reserves declined by a record $108 billion, bringing the total drop for 2015 to over half a trillion, and the cumulative decline since Chinese reserves starting dropping in mid-2014 to just shy of $1 trillion.

Â

But why if China has been so keen on devaluing its currency – at least since the formal start of the devaluation on August 11 – was it selling so many USD-denominated assets? The answer: because if the PBOC did not step in and halt the decline (by liquidating reserves) the drop would have been even greater, suggesting that the capital outflow from China is orders of magnitude worse than either Beijing, or Chinese analysts would like to admit.

One thing is certain: there is much more depreciation to go. As we reminded readers yesterday, one month ago we predicted at least another 15% in CNY devaluation, something Bloomberg agreed with over the weekend. And as China devalues more, it will face even more outflows: agreed with over the weekendwhich will drastically cut the country’s pile of FX reserves at the worst possible time – just as China’s banks are forced to begin recognizing the huge pile of non-performing loans as a result of a tsunami of pent up corporate defaults mostly in the commodity sector.

All that assume a continuation of the smooth devaluation seen since the August 11 shocker.

As SocGen points in a note today, “press reports at the end of last week suggested that senior policy advisors would like to see a sharp one-off depreciation of the CNY. The theory is that once such a move had been accomplished, the domestic capital outflows, that are putting additional pressure on China’s financial system and draining the FX reserve, would stop. The same policy advisors, however, recognise the dangers of such a strategy. First, domestic savers may not believe a “one-and-done†strategy, risking further capital outflows. Second, China’s political standing in the G20 group could well suffer as a result, which is important point to the current administration. Finally, the potential disruption to financial stability outside China, and with the risk of an Asian currency war, would ultimately feedback negatively to China.