Mastercard Incorporated (MA - Free Report) reported adjusted earnings of $1.66 per share, beating the Zacks Consensus Estimate of $1.53. Earnings improved 48% year over year (on a currency neutral basis). Improved revenues drove the earnings upside.

Better-than-expected results were primarily backed by higher switched transactions, increase in cross-border volume and gross dollar volume as well as gains from acquisitions. An increase in rebates and incentives year over year was a partial dampener.

Shares, however, lost 2.5% in the pre-market trading session.

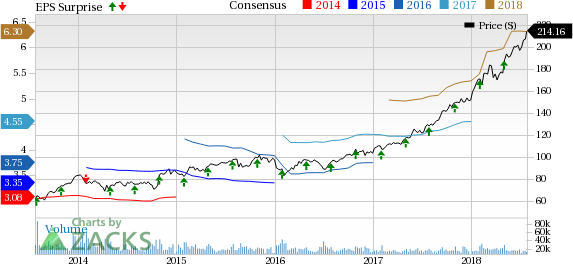

Mastercard Incorporated Price, Consensus and EPS Surprise

Mastercard Incorporated Price, Consensus and EPS Surprise | Mastercard Incorporated Quote

Strong Operational Performance

Mastercard’s revenues of $3.7 billion surpassed the Zacks Consensus Estimate of $3.66 billion. Revenues were up 18% year over year (on a currency neutral basis).

Total adjusted operating expenses increased 6% to $1.5 billion, due to higher, general and administrative expenses, advertising and marketing expenses, depreciation, and provision for litigation expenses.

Operating margin expanded 470 basis points to 59%.

Gross dollar volume increased 14% while cross-border volumes were up 19% on a local currency basis.

The company’s margins gained from a lower tax rate of 18.3% in the second quarter that compares with 27.7% in the year-ago quarter.

As of Jun 30, 2018, the company’s customers had issued 2.4 billion Mastercard and Maestro-branded cards, adjusted for the impact of the Venezuela deconsolidation.

Financial Update

As of Jun 30, 2018, the company’s cash and cash equivalents were $6.21 billion, up 4% from the level at year-end 2017. Long-term debt was $5.86 billion, up 8% from the mark at 2017 end.

Share Repurchase and Dividend Payment

During the reported quarter, Mastercard repurchased shares worth $1.5 billion and returned $262 million in dividends.