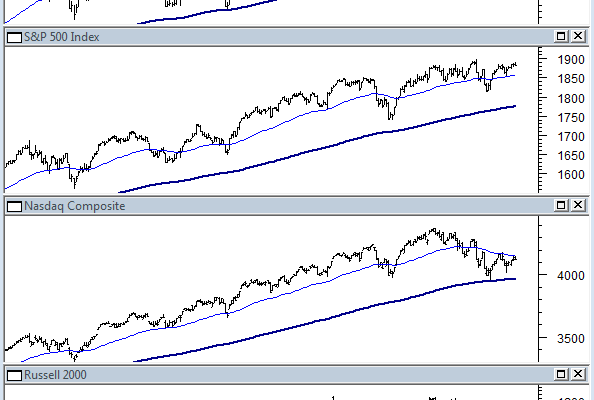

For the last few months the major indexes have been diverging from each other. Â While the Dow Jones Industrial Average (DJIA) and the S&P 500 Index (SPX) have traveled sideways in a range, the Nasdaq Composite and Russell 2000 Index (RUT) fell to their 200 day moving averages and bounced back to their 50 dma. Â As you must know by now this is a result of rotation out of the high fliers from 2013 into large cap and value stocks. Â The rotation caused damage in Nasdaq and RUT while at the same time kept SPX and DJIA in the range (DJIA made a marginal new high this week, but not a clean break of the range).

With Nasdaq and RUT stuck in the middle of moving averages and SPX and DJIA stuck in a range it’s decision time.  Over the next few weeks the market will most likely turn over and start a down trend or break higher out of the current range.  I wish I could tell you which direction it will move, but I can’t see the future.  As I mentioned yesterday, our indicators are giving a 60% chance for a resumption of the uptrend and 40% chance of making an intermediate term top.  Our core indicators are still somewhat cautious, but improving, which is in line with the picture we get from simply looking at the major indexes.

Our Twitter (TWTR) Sentiment Indicator for the S&P 500 index (SPX) is giving some mixed signals. Â On the positive side, the move out of the mid April low brought with it a strong move in sentiment. Â Daily sentiment has had several prints in the +20 area after that low. Â Smoothed sentiment moved back above zero, above its recent down trend line, and above its previous peak. Â All of these argue for higher prices. Â In addition, traders on Twitter are now starting to call for price targets above the 1900 level on SPX. Â The 1920 area and 1940 are the most tweeted levels.

On the negative side, daily sentiment has been weak over the past several days as the market moved higher.  Market participants aren’t extremely optimistic about SPX breaking over 1900.  This is causing smoothed sentiment to paint a negative divergence from price.  Another negative is that there are more calls for prices below the market than above.  The most tweeted levels are 1850 and 1840.