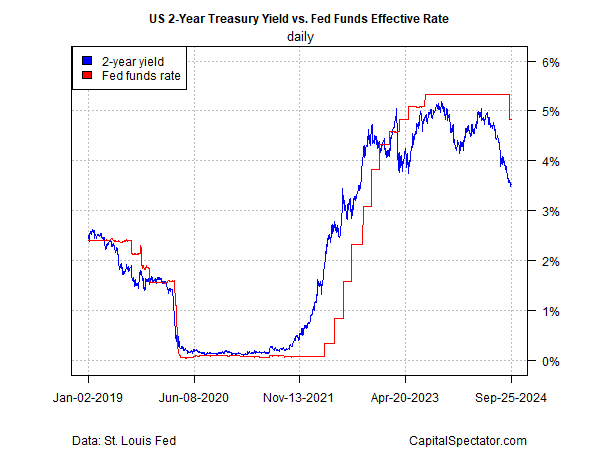

Markets are highly confident that the Federal Reserve will announce another cut in interest rates at the next policy meeting on Nov. 7, two days after the election. The uncertainty is whether the cut will be 25 or 50 basis points. this morning are favoring a 50-basis-points cut. The implied probability is roughly 61% vs. 39% estimate for a ¼-point cut. Based on this data, the chance that the Fed will leave rates unchanged is virtually nil.Meanwhile, the policy-sensitive 2-year US Treasury yield continues to trade far below the current 4.75%-to-5.0% range, which the Fed reduced last week by 50 basis points. The 2-year yield is considered a market proxy forecast for the Fed’s target rate. On that basis, the 2-year yield’s 3.56% yield (Sep. 25) continues to imply that the central bank will reduce interest rates in the near term.

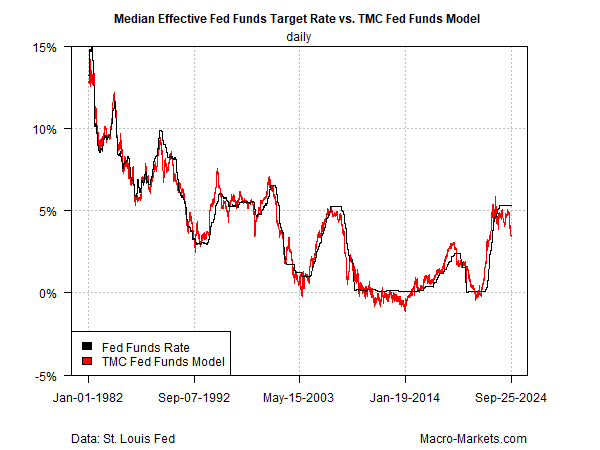

A multi-factor model I designed for is also reflecting a strong case for more rate hikes (for details on the inputs, see this .) The model’s current estimate of the “optimal” Fed funds rate is roughly 3.4% — sharply below the current target rate.

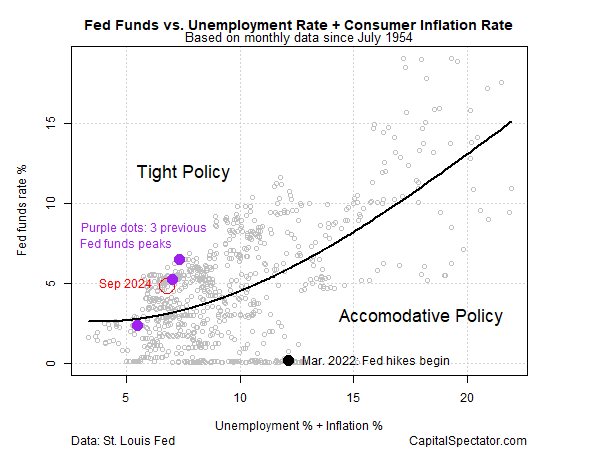

For another perspective, consider how another model (consumer inflation + the unemployment rate) relates with the current Fed funds rate. On this basis, monetary policy still looks tight. Here, too, the implied forecast for more easing looks prudent. More By This Author:U.S. Still On Track To Avoid Recession In Q3Gold Is Enjoying A Banner Year Despite Softer InflationGDP Nowcasts Still Indicate Low Recession Risk For U.S. In Q3

More By This Author:U.S. Still On Track To Avoid Recession In Q3Gold Is Enjoying A Banner Year Despite Softer InflationGDP Nowcasts Still Indicate Low Recession Risk For U.S. In Q3

Markets Lean Into Another ½-Point Rate Cut By The Fed