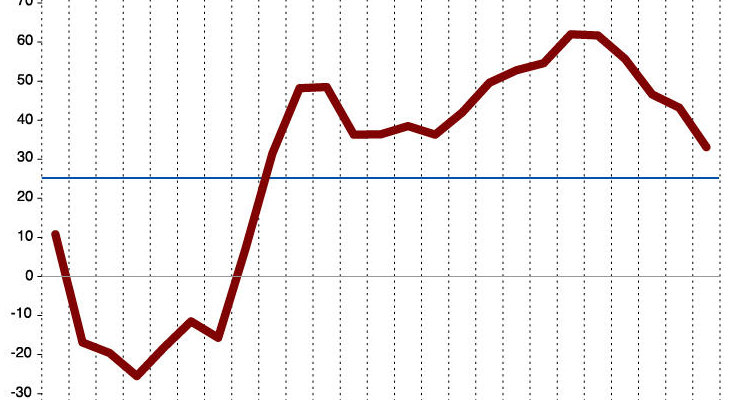

Economic sentiment in Germany showed another decline this month, as measured by the Centre for European Economic Research (ZEW) Index. This is a widely watched indicator and it further raised expectations of an ECB monetary easing action.

Source: ZEW

Moreover, rumors are circulating that Bundesbank, which in the past resisted additional monetary stimulus, may now in fact support such an action by the ECB. The euro, which started declining after Draghi’s speech on May 8th (see post), traded lower.

Reuters: – Selling of the euro accelerated on Tuesday after a report from Dow Jones, citing a person familiar with the matter, said the Bundesbank, Germany’s central bank, was willing to back an array of stimulus measures from the European Central Bank next month.Â

The measures could include backing a negative interest rate on bank deposits and ECB purchases of packaged bank loans if needed to boost inflation.

Source: Investing.com

German government yields also fell to lows not seen in about a year, with the market now pricing in some form of an easing action from the ECB next month.

Source: Investing.com

Now the ECB is under the gun to come up with something in June to maintain its credibility. The risk of course is that if we hear the same old “wait and see” approach, yields across the euro area will back up violently. Â