The Most Non-Surprising FOMC Statement Ever

Kremlinologists were probably a bit baffled by the brevity and complete lack of surprises in yesterday’s press release by the preeminent US central economic planning agency. What else was supposed to happen though?

Readers can compare the statement with the previous one with the help of the WSJ’s trusty statement tracker. Try not to fall asleep while reading it. However, the Fed has taken steps to enable the broadcasting of timely information by testing a new internal teleconference system with reporters. You know, just in case something more interesting happens, like a rate hike. Or an emergency intra-meeting meeting (possibly shortly after the rate hike). Why would there be an emergency you ask? Isn’t everything just hunky-dory? Well…before we get to that, here are the handful of sentences from the statement that are worth knowing:

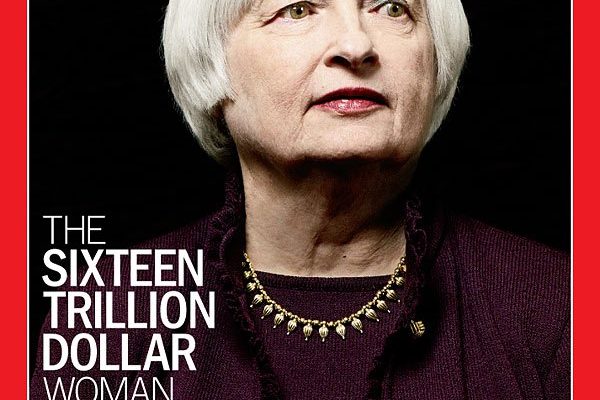

What, $16 trillion? Is it? My, we seem to have lost count …

“To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.â€

We actually have a modest proposal with respect to the wording that could help to inject even more to the point brevity into the statement:

“In spite of lots of “incoming informationâ€, we still haven’t the foggiest clue what we are doing or what any of it means. We’re all praying that this sucker doesn’t blow up into our faces before we’ve sailed off into retirement. As to us ever shrinking the balance sheet again or actually doing something that might be remotely reminiscent of tightening, forget it dude. Do you think we want to be blamed for another crash?â€

OK, maybe we’re not giving them enough credit for the rate hike box they have talked themselves into. In fact, we believe there is very little awareness at the Fed of how dangerous a bubble it and other central banks have blown in the meantime. The associated wake-up call is unlikely to be expected when it eventually arrives.