With key economic data either behind us (with the downward revised GDP), or ahead of us (the February payrolls on deck), and the Greek situation currently shelved if only for a few days/weeks until the IMF payment comes due and the farce begins anew, stocks are focusing on the widely telegraphed 25 bps Chinese rate cut over the weekend, which however has so far failed to inspire a broad based rally either in Asia (where the SHCOMP closed up 0.8% after first dipping in the red) or across developed markets. In fact, as of this moment futures are hugging the unchanged line as the USDJPY attempted another breakout of 120.000 but with numerous option barrier expiration stop at that level, it has since retracted all the overnight gains and is back to the Sundey lows, even as the EURUSD has seen a powerful breakout from overnight lows and is currently at the highest level since the US GDP print, following the release of the final European February PMI data, as a result of USD weakness since the European open.

Look at regional performance, Asian equities traded mostly higher as the PBoC cut its benchmark interest rate. The bank lowered its benchmark interest rate by 25bps to 5.35%, citing deflationary risk and the property market slowdown. It also lowered the 1yr deposit rate to 2.5% and lifted the ceiling on the deposit rate to 1.3x the benchmark rate. Shanghai Comp (+0.8%) and Hang Seng (+0.3%) traded in the green, despite fluctuating between losses and gains, following an initial pessimistic reaction to the central banks’ actions. Nikkei 225 (+0.15%) traded on a caution note, paring back earlier gains following yet another surge to a fresh 15yr high. Chinese HSBC Manufacturing PMI (Feb F) M/M 50.7 vs. Exp. 50.1 (Prev. 50.1); 7-month high. Official Manufacturing PMI (Feb) M/M 49.9 vs. Exp. 49.7 (Prev. 49.8); second consecutive contraction. Chinese Non-manufacturing PMI (Feb) M/M 53.9 vs. Prev. 53.7 (BBG).

The first session of the week sees European equities trade mostly in positive territory in the aftermath of the latest action by the PBoC. This subsequently supported Asian equities overnight, although gains were capped as some participants have concerns over Chinese growth prospects and the timing of the cut, suggesting it may have come too late. Nonetheless, with European news flow relatively light, this has been enough to provide a lift to stocks, with the exception of the CAC which has been dragged lower following earnings from Vivendi. In fixed income markets, Bunds ebbed lower alongside the strength in stocks. Of note, today sees EUR 12.4bln in redemptions from Italy, while peripheral yields have continued to print further record lows ahead of the upcoming launch of the ECB’s bond buying programme.

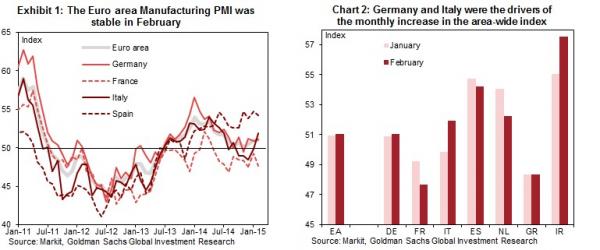

Also today we got the final Euro area Manufacturing PMI, which came in at 51.0 in February, marginally weaker than the flash estimate. Overall, the area-wide Manufacturing PMI has been stable in February. Improvements in the Manufacturing PMIs for Germany and Italy — which increased by 0.2pt (to 51.1) and 2.0pt (to 51.9) respectively — were offset by similar-sized contractions in France (-1.6pt to 47.6) and Spain (-0.6pt to 54.2). While the Italian manufacturing PMI came in 0.8pt above market expectations, the Spanish equivalent undershot expectations by 0.9pt.

In the US, some are focusing on the latest piece by Fed mouthpiece Jon Hilsenrath, who says the Fed’s latest forecast show 9 out of 17 policy makers see the Feds fund rate at 1.13% or higher by year-end. The median estimates point to 2.5% for the end-2016 and 3.63% end-2017. Conversely, Fed funds futures markets expect the Feds fund rate at 0.50% on avg. in Dec’15, 1.35% in Dec’16 and 1.84% Dec’17.

Today we get US personal spending (1330GMT/0730CST) and construction data (1500GMT/0900CST) although these may be delayed today due to the adverse weather in Washington DC.

In FX markets, AUD/USD and NZD/USD were both seen lower overnight ahead of Tuesday’s RBA rate decision, with markets currently pricing in a 58% chance for a 25bps rate cut. This subsequently initially strengthened the USD-index which saw USD/JPY surge to a 2-week high to trade just 4 pips shy of the 120.00 handle, with further moves higher capped by a large vanilla option expiry (1.2bln) at the handle. Nonetheless, the USD-index has come off its best levels throughout the morning amid no new fundamental news, much to the benefit of EUR, leading EUR/GBP higher, although GBP gained back some ground in the wake of the latest UK manufacturing PMI data (54.1 vs. Exp. 53.3).

In the commodity complex, Gold gained overnight with prices supported following the surprise PBoC rate cut over the weekend, while India is also expected to increase its imports of the precious metal despite the government maintaining import duties, as industry participants which were side-lined in anticipation of a cut in duties, return to the market to replenish stockpiles. In energy markets, both WTI and Brent crude futures have traded lower since the get-go following the latest survey data which revealed Saudi Arabia’s output rose +130,000bpd to 9.85mln bpd in Feb; highest since Sept’13. Furthermore, Friday’s Baker Hughes Rig Count which showed a slowing of the rate at which US rigs are becoming idle has also weighed on sentiment.