Image Source: After writing so much about the virtues of low-yield, high-growth stocks, it’s time to talk a bit about high-yield stocks. To be fair, they’re not all bad investments. Some provide a fairly sustainable source of high income for investors, and some even manage to beat the market.

Image Source: After writing so much about the virtues of low-yield, high-growth stocks, it’s time to talk a bit about high-yield stocks. To be fair, they’re not all bad investments. Some provide a fairly sustainable source of high income for investors, and some even manage to beat the market.

High Yield U.S. Stocks that Keep Giving

I searched for high yield companies that also matched the overall stock market performance as of late. On Oct. 7, the SPDR S&P 500 ETF Trust () five-year total return (capital + dividends) was about 74%, and the iShares S&P/TSX 60 ETF (XIU.TO) was about 52%. So, I search for all companies generating a total five-year return of at least 50% and a yield of at least 6%. This returned 101 stocks.Here are three of the U.S. stocks that provided high yields while matching or outperforming the market for total return over the last five years. Keep in mind that there is no guarantee that they will keep performing that well in the future, especially with a long-predicted recession looming. As always, do your due diligence when considering any investment.

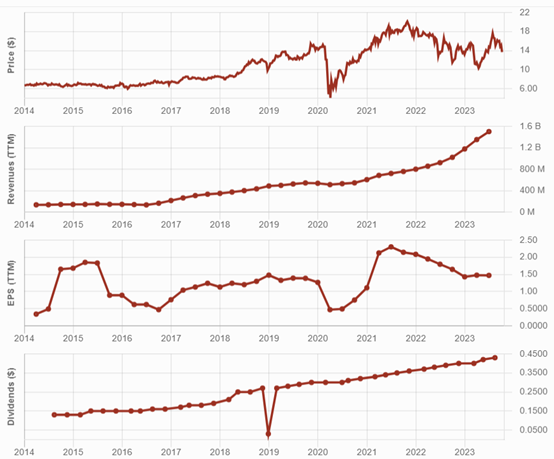

Arbor Realty Trust (ABR) 11.28% Yield, +107.2%

ABR is probably the only mortgage REIT worth considering, in my opinion. Most mortgage REITs fail their shareholders with dividend cuts or a lack of dividend growth. ABR has performed well over the past 10 years and shows consistent dividend growth. Looking at its dividend triangle, you might think it’s not actually a mortgage REIT. While the company’s interest rate spread is shrinking, ABR still generates positive cash flow and compensates with an aggressive loan origination program. The company’s success results from the combination of a strong and experienced management team, bridge financing which makes it easier to match interest rate fluctuations, a robust balance sheet, and an aggressive loan origination policy to compensate for weaker interest margins.ABR’s stock price has remained relatively stable over time, and the dividend keeps increasing.

While the company’s interest rate spread is shrinking, ABR still generates positive cash flow and compensates with an aggressive loan origination program. The company’s success results from the combination of a strong and experienced management team, bridge financing which makes it easier to match interest rate fluctuations, a robust balance sheet, and an aggressive loan origination policy to compensate for weaker interest margins.ABR’s stock price has remained relatively stable over time, and the dividend keeps increasing.

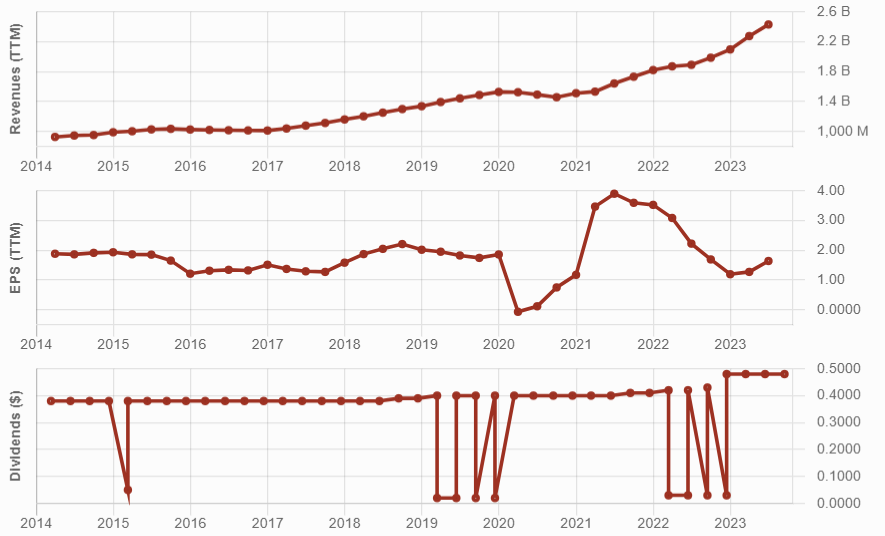

Ares Capital (ARCC) 9.94% Yield, +90.28%

ARCC is another solid business development company (BDC) that currently holds a great loan portfolio. ARCC successfully survived the 2008 financial crisis. It did so with a dividend cut, but it managed to build back a solid business.It did it again in early 2020, when it was priced for a dividend cut. Fortunately, the economy recovered faster than expected, its stock price recovered nicely, and ARCC increased its dividend, before increasing it again in late 2022.Looking at its dividend triangle, you may see that the dividend follows an odd-looking pattern. That’s because ARCC pays an extra $0.03/share on top of the quarterly dividend. (Click on image to enlarge)Risks surrounding BDCs are difficult to understand when the economy thrives; businesses pay their loans, lenders make money. However, even though ARCC survived the last recession, it took a while to get back to its 2008 level of $0.42/share, and its stock dropped from $20 to below $5 in the midst of the recession.While the near 10% yield is attractive, the dividend is the only return investors get from ARCC. It’s worth remembering that dividend cuts happen quickly when recessions hit. Higher interest rates mean higher revenue for ARCC, but they could also cause a higher default rate on loans they hold. The main concern at the moment is the uncertain economic environment, which might not be favorable for ARCC.

(Click on image to enlarge)Risks surrounding BDCs are difficult to understand when the economy thrives; businesses pay their loans, lenders make money. However, even though ARCC survived the last recession, it took a while to get back to its 2008 level of $0.42/share, and its stock dropped from $20 to below $5 in the midst of the recession.While the near 10% yield is attractive, the dividend is the only return investors get from ARCC. It’s worth remembering that dividend cuts happen quickly when recessions hit. Higher interest rates mean higher revenue for ARCC, but they could also cause a higher default rate on loans they hold. The main concern at the moment is the uncertain economic environment, which might not be favorable for ARCC.

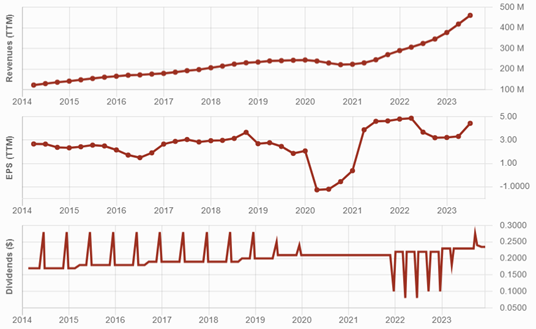

Main Street Capital (MAIN), 7.80% Yield, +58.62%

Almost matching the market but not quite, I include Main Street Capital here because I think this one is still worth a look.MAIN pays a monthly dividend, providing an approximate 7% yield, and it has paid a special dividend annually to sweeten the deal for its investors. MAIN skipped the special dividend for a few years following the COVID-19 crash, but it paid one in 2023.This business development company (BDC) is among the most respected and well-run in its industry. The company has never failed shareholders, and it demonstrates a meticulous underwriting process to avoid bad loans.Overall, MAIN pays a generous dividend and still increases its net asset value (NAV) per share on a consistent basis. The BDC also performed well during the financial crisis of 2008. I’ve never been fond of BDCs, they usually appear to be fine only during economic booms, but MAIN seems to be in its own class. Wherever there are loans and high dividend yields, there is some inherent risk. However, MAIN seems able to manage its loan portfolio with great prudence. The reason for its high yield is primarily the company’s business model that requires distributing of most of its profit to shareholders.Still, keep in mind that the BDC industry involves lending to businesses that can’t obtain better lending conditions from banks due to their risk or credit profile. To date, MAIN has proven that its loan portfolio is in good health, but investors should exercise caution in light of the uncertain economic landscape.

Wherever there are loans and high dividend yields, there is some inherent risk. However, MAIN seems able to manage its loan portfolio with great prudence. The reason for its high yield is primarily the company’s business model that requires distributing of most of its profit to shareholders.Still, keep in mind that the BDC industry involves lending to businesses that can’t obtain better lending conditions from banks due to their risk or credit profile. To date, MAIN has proven that its loan portfolio is in good health, but investors should exercise caution in light of the uncertain economic landscape.

Last Thoughts About High Yield U.S. Stocks

As you know, I prefer higher total return over high yield. Overall, low yield, high growth stocks provide higher total return, so I favor them for my dividend growth investment strategy. However, a few solid higher yield companies that match or exceed the market can be good assets to have in a portfolio. Be sure to monitor them quarterly though, to ensure they don’t become .More By This Author:Optimize Your Portfolio ReviewIs It Time to Sell Your REITs?Deluxe Bonds And Dividend Traps

Market-Beating High Yield U.S. Stocks