This week’s initial peek at the March economic profile for the US via Markit’s survey data for manufacturing delivered upbeat news, which takes some of the edge off for expecting trouble. Later today we’ll see the equivalent for the services sector. Economists via Econoday.com’s consensus forecast are anticipating that the PMI Services Index will hold on to recent gains, in which case we’ll have a new clue for expecting brisk growth for this corner of the economy. But while the tail-end of the first-quarter is showing mild signs of revival, the outlook for Q1 GDP continues to stumble.

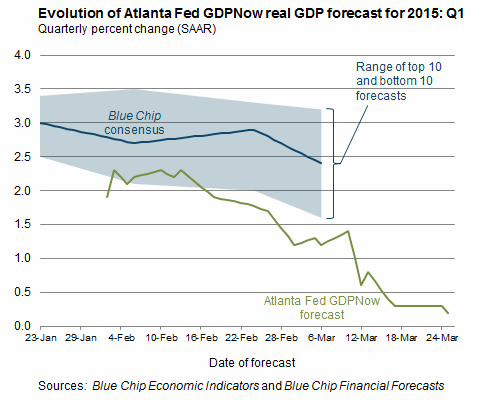

The case for managing expectations down starts with the latest GDP-Now estimate from the Atlanta Fed. Yesterday’s update trimmed the outlook for first-quarter GDP growth to a thin 0.2%, down from the previous estimate of 0.3%. The new revision reflects yesterday’s disappointing news on durable goods orders for February.

Wall Street is paring Q1 GDP forecasts as well. CNBC reports that its average of Wall Street tracking estimates for growth in this year’s first quarter fell to 1.8%–the lowest forecast to date for Q1 projections via CNBC’s data set. Compared with the Atlanta Fed model’s outlook for something close to stagnation, however, a 1.8% advance looks relatively encouraging.

In any case, the consensus outlook now expects that first quarter growth will decelerate from the 2.2% rise in last year’s fourth quarter. The only question is by how much? The answer arrives in the “advance†estimate for Q1 GDP, which is scheduled for release on April 29.

One source of the softer estimates is linked to the recent strength in the US dollar. “We’re definitely seeing the impact from the stronger dollar — it’s evident in manufacturing surveys and production data,†Chris Low, chief economist at FTN,tells Bloomberg.

In the wake of the softer numbers, it’s reasonable to wonder: What’s the fallout for the labor market? Growth in payrolls has been robust, at least through the February data. Will the March update that’s due next week tell us otherwise?