Image Source:

Image Source:

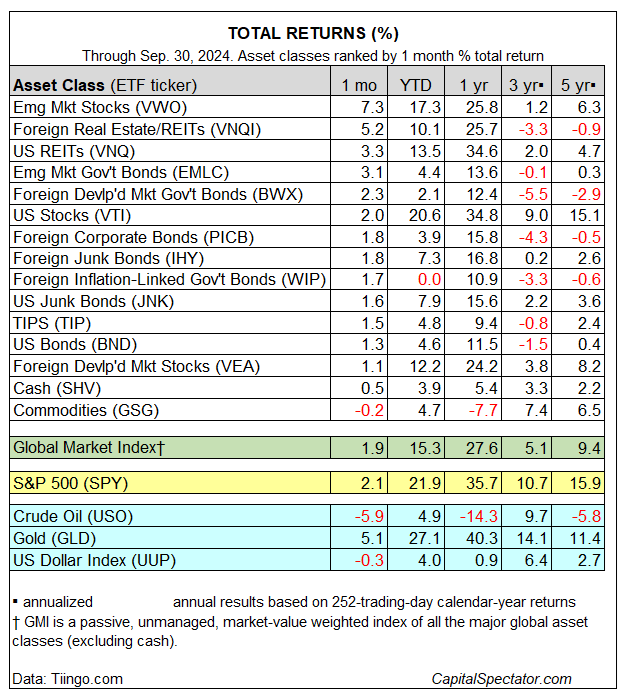

Emerging-markets stocks surged in September, delivering the lead performance for the major asset classes, based on a set of ETFs. Real estate shares were also strong performers last month, extending recent strength for these stocks. Commodities, once again, were the downside outlier.Vanguard Emerging Markets () rose a sizzling 7.3% in September, beating the rest of the field by a wide margin. The gain marks the eighth straight monthly increase for the ETF and the strongest rally in nearly two years. A key driver of last month’s red-hot rise for these shares: A dramatic rebound in China stocks following news of a more aggressive stance on stimulus programs to support the country’s slowing economy.Foreign property () and US real estate investment trusts () continued to post strong gains last month. September marks a third straight month that property shares posted leading (or in September’s case near-leading) returns relative to the rest of the field.

US stocks () and bonds () continued rising last month. The only loser in September was commodities (). The 0.2% dip for raw materials marks the third straight monthly decline. Gold (), however, is bucking the trend for commodities writ large with another strong monthly rise of 5.1%.For year-to-date results, rallies dominate the field, led by US shares () with a 20.6% gain for 2024. The weakest performer this year: foreign inflation-linked government bonds (), which is flat so far in 2024.The Global Market Index (GMI) posted its fifth straight monthly gain, advancing 1.9% in August. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios. Year to date, GMI is up a strong 15.3%.For the one-year window, GMI continues to reflect a middling performance relative to US stocks (VTI) and US bonds (BND). More By This Author:

More By This Author:

Major Asset Classes – September 2024