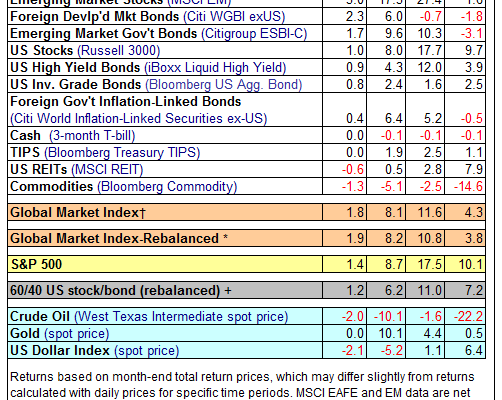

Foreign markets led most of the major asset classes higher in May. The top performer: foreign high-yield bonds. Markit’s Global ex-US High Yield Index popped 3.8% last month (in unhedged US dollar terms), posting its biggest monthly gain in more than a year. The only losers in May: US real estate investment trusts (MSCI REIT) and commodities (Bloomberg Commodity), which fell 0.6% and 1.3%, respectively.

Markets outside the US dominated last month’s winner’s list, in part due to a tailwind from a weaker dollar. All else equal, a softer greenback translates into higher prices in foreign currencies sans hedging from a US investor’s perspective. Last month’s 2.0% slide in the US Dollar Index (USD) marks the third straight monthly decline for the currency benchmark. So far this year, USD is off 5.2%.

The generally rising tide in markets in May continued to lift the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI increased 1.8% last month, its sixth straight monthly advance. On a year-to-date basis, the benchmark’s total return is in the black by a strong 8.1%.