Wall Street bulls finally got what they have been wishing for: a dovish Fed. Jay Powell and Co. gave the green light to market bulls last week when the world’s most important central bank signaled the possibility of three interest rate cuts in 2024.The S&P 500 is closing in on new all-time highs and the market hasn’t even hit the official Santa Claus rally period.Markets never go straight up, so investors should expect some sideways movement and selling in the coming weeks and months. But the stock market looks primed for a solid 2024 as the math on cash and bonds changes and more investors join the party, worried they might miss out on another prolonged rally.

Arista Networks (ANET)Arista Networks is a networking infrastructure provider, with solutions that range from IP storage and big data to AI networking and beyond. ANET has more than 8,000+ cloud customers worldwide, including Microsoft ((MSFT Quick Quote – ) ) and Meta ((META Quick Quote – ) ). Arista Networks’ offerings are clearly at the cutting edge and critical when two global technology superpowers are huge customers. ANET is projected to grow its sales by 34% in FY23 and 12% next year to climb from $4.38 billion in FY22 to $6.52 billion in FY24. This expected top-line growth follows 23% average revenue expansion over the past five years.(Click on image to enlarge) Image Source: Zacks Investment ResearchThe networking infrastructure firm’s adjusted earnings are projected to soar 43% this year and 10% higher next year. Arista Networks boosted its bottom-line outlook once again when it reported its Q3 results to help it grab a Zacks Rank #2 (Buy) and extend its impressive streak of upward earnings revisions.Arista Networks shares have soared 1,600% during the last 10 years vs. the Zacks Tech sector’s 250%, Microsoft’s 910% and Meta’s 510%. This outperformance includes a 95% surge in 2023 that has it sitting at fresh all-time highs.On the valuation side, ANET trades at a nearly 50% discount to its decade-long highs and not too far above its median. Arista Networks has an impressive balance sheet and Wall Street is high on the stock.

Image Source: Zacks Investment ResearchThe networking infrastructure firm’s adjusted earnings are projected to soar 43% this year and 10% higher next year. Arista Networks boosted its bottom-line outlook once again when it reported its Q3 results to help it grab a Zacks Rank #2 (Buy) and extend its impressive streak of upward earnings revisions.Arista Networks shares have soared 1,600% during the last 10 years vs. the Zacks Tech sector’s 250%, Microsoft’s 910% and Meta’s 510%. This outperformance includes a 95% surge in 2023 that has it sitting at fresh all-time highs.On the valuation side, ANET trades at a nearly 50% discount to its decade-long highs and not too far above its median. Arista Networks has an impressive balance sheet and Wall Street is high on the stock.

Shift4 Payments (FOUR)Shift4 Payments is an integrated payment processing solutions leader that captures a Zacks Rank #1 (Strong Buy) right now. Shift4 Payments’ offerings span in-person and digital, helping run payment infrastructure across various industries. Shift4 Payments’ client list is strong, ranging from Hilton and to Little Caesars pizza.FOUR’s end-to-end payment volume climbed 36% YoY in Q3 to $27.9 billion, with gross profit up 34%. Shift4 Payments has topped our quarterly EPS estimates by an average of 25% in the trailing four quarters, including a 17% Q3 beat.(Click on image to enlarge) Image Source: Zacks Investment ResearchShift4 Payments’ FY24 consensus earnings estimate is up 14% since its last report. FOUR’s adjusted EPS are projected to grow by 110% and 30%, respectively in FY23 and FY24 on 31% and 37% higher revenue that would see it expand from $727.5 million last year to $1.30 billion next year.FOUR stock has climbed by 120% since its summer 2020 IP0. Shift4 Payments shares have surged 32% in 2023 to retake their 50-day and 200-day moving averages recently.Despite the overall strength, Shift4 Payments trades 27% below its 2021 highs. FOUR also trades at a discount to the Zacks tech sector at 23.4X forward 12-month earnings, marking a 90% discount to its peaks. And its earnings outlook for FY24 and FY25 have continued to improve.

Image Source: Zacks Investment ResearchShift4 Payments’ FY24 consensus earnings estimate is up 14% since its last report. FOUR’s adjusted EPS are projected to grow by 110% and 30%, respectively in FY23 and FY24 on 31% and 37% higher revenue that would see it expand from $727.5 million last year to $1.30 billion next year.FOUR stock has climbed by 120% since its summer 2020 IP0. Shift4 Payments shares have surged 32% in 2023 to retake their 50-day and 200-day moving averages recently.Despite the overall strength, Shift4 Payments trades 27% below its 2021 highs. FOUR also trades at a discount to the Zacks tech sector at 23.4X forward 12-month earnings, marking a 90% discount to its peaks. And its earnings outlook for FY24 and FY25 have continued to improve.

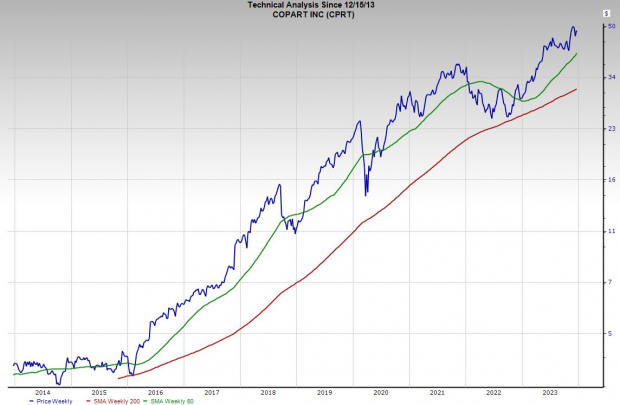

Copart, Inc. (CPRT)Copart is an online vehicle auction powerhouse that attempts to bring together sellers to more than 750,000 members in over 190 countries. Copart’s platform helps process and sell vehicles to dealers, dismantlers, rebuilders, exporters, and the general public. Copart sells vehicles for insurance companies, banks, fleet operators, dealers, vehicle rental firms, individuals, and beyond. Copart’s growth has been steady and strong, averaging 18% sales expansion over the last seven years.Copart’s revenue is projected to climb 10% this year and 8% next year to hit $4.59 billion. The company’s adjusted EPS are expected to surge 15% and 9%, respectively. Copart’s history of earnings beats is solid and its upward EPS revisions help it land a Zacks Rank #2 (Buy) at the moment.(Click on image to enlarge) Image Source: Zacks Investment ResearchCPRT stock has soared 1,000% over the last 10 years to blow away the S&P 500’s 167%. Copart’s outperformance includes a 60% climb in 2023. The stock has pulled back after posting new records in late November, but it recently found support at its 50-day moving average.On the valuation front, Copart trades at a 21% discount to its highs at 32.8X forward earnings. Copart’s balance sheet is also stellar, with $2.58 billion in cash and equivalents and $7.33 billion in total assets vs. $897 million in total liabilities. More By This Author:3 Highly-Ranked Stocks To Buy Now For A Big 2024 Comeback 2 Top-Ranked Tech Stocks To Buy Now For A Potential Santa Claus RallyBear Of The Day: Sonos, Inc.

Image Source: Zacks Investment ResearchCPRT stock has soared 1,000% over the last 10 years to blow away the S&P 500’s 167%. Copart’s outperformance includes a 60% climb in 2023. The stock has pulled back after posting new records in late November, but it recently found support at its 50-day moving average.On the valuation front, Copart trades at a 21% discount to its highs at 32.8X forward earnings. Copart’s balance sheet is also stellar, with $2.58 billion in cash and equivalents and $7.33 billion in total assets vs. $897 million in total liabilities. More By This Author:3 Highly-Ranked Stocks To Buy Now For A Big 2024 Comeback 2 Top-Ranked Tech Stocks To Buy Now For A Potential Santa Claus RallyBear Of The Day: Sonos, Inc.

Looking For Stocks To Buy In 2024? Here Are 3 Strong Picks