It’s going to be an exciting week on Wall Street as the new earnings season begins to pick up speed. What should investors watch for in Bank of America Corp (BAC), Intel Corporation (INTC), and General Electric Company (GE)?

Bank of America

Bank of America is set to announce its second quarter 2015 earnings results on Wednesday, July 15 before the market opens. Analysts expect the company to post earnings of $0.36 a share and $21.30 billion in revenue, up from $0.19 earnings per share but down from $21.96 billion in revenue the same quarter a year prior.

It is worth noting that Bank of America has posted revenue below analysts’ estimates for the past three consecutive quarters. With that said, the bank’s Consumer Banking unit is projected to improve this quarter due to core deposit growth. Investors see this as a good sign as Bank of America’s Consumer Banking unit generates approximately 36% of its revenue.

Bank of America has also been dealing with legacy disputes and new regulations ever since the 2008 financial crisis. As a result, Bank of America’s earnings results have been clouded by investors worrying about legal liabilities arising from the subprime mortgage crisis. However, the bank’s legal disputes have been settled and now investors can focus on the future.

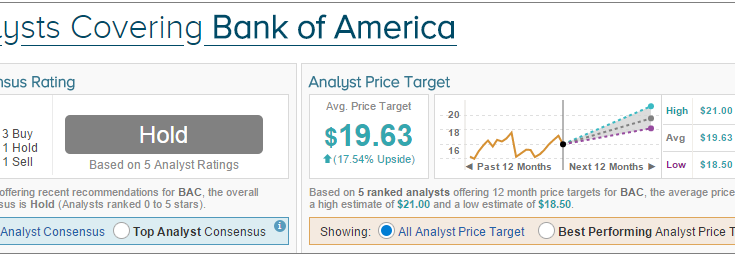

Out of five analysts polled by TipRanks, three are bullish on Bank of America, one is bearish, and one is neutral. The average 12-month price target for Bank of America is $19.63, marking a 17.54% potential upside from where the stock is currently trading. On average, the all analyst consensus for Bank of America is Hold.

Intel Corp

Intel will post second quarter 2015 earnings results on Wednesday, July 15 after market close. The company is expected to post earnings of $0.51 per share and $13.07 billion in revenue, falling from $0.55 earnings per share and $13.83 billion in revenue year-over-year.

The upcoming earnings report is expected to be the first in two years to post a year-over-year sales decline due to decreasing demand in the PC business. Intel is one of the biggest providers of PC’s and servers. Prior to its earnings, Intel called the PC business “challenging†and slashed its capital spending plan from $10 billion to approximately $8.7 billion.